Graphano Energy Ltd. has published an initial mineral resource estimate for its graphite properties located in the Lac Saguay region of Québec. The company reports an indicated mineral resource of 1.64 mn tonnes at 7.00% graphitic carbon, containing 115,000 tonnes of graphitic carbon, and an inferred resource of 1.58 mn tonnes at 7.00%, for 111,000 tonnes of graphitic carbon. The estimate was completed in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) standards and is based on both recent and historical drilling across multiple site zones.

High-grade resources accessible at surface

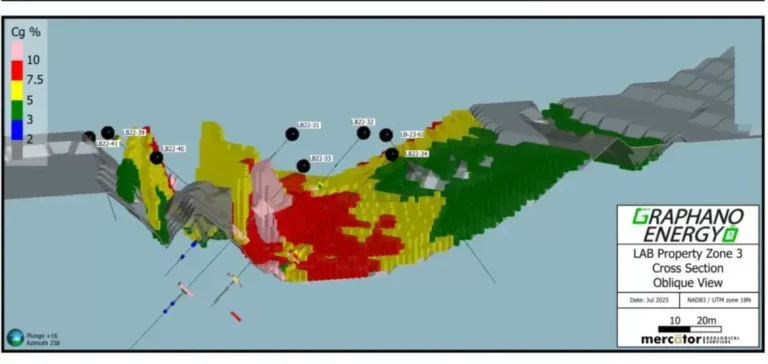

The deposit features near-surface mineralisation with minimal overburden, offering immediate access and opportunities for selective mining. The mineral resources are located close to key transportation routes and the permits cover ground adjacent to the Lac-des-Îles processing plant. The project comprises both the LAB and Standard properties, including the Pit Zone, Zone 1, Zone 3, and Standard, which have been the focus of recent exploration efforts.

Graphano Energy notes that the estimate demonstrates significant potential for development both between and within existing pit shells, as well as the identification of six additional mineralisation zones on the LAB property. These potential extensions, identified through geophysical work, are expected to be the focus of future drilling campaigns to expand resources.

Economic parameters and development stages

Resources have been defined within an optimised pit shell, based on a long-term price of $1,500 per tonne (USD) for graphite concentrate, with an overall metallurgical recovery rate of 90%. Costs considered include $4.50 per tonne for mining, $30 per tonne for processing, $12 per tonne for general administration, and $22 per tonne for transport, all calculated at an exchange rate of 1.35 CAD per 1 USD.

The development programme includes a conversion drilling campaign to upgrade the resource classification, bulk sampling for metallurgical testing and surface extraction cost analysis, as well as environmental studies required for permitting. All samples collected were analysed by Activation Laboratories, an ISO-certified laboratory in Ontario, following industry standards to ensure data quality.

Independent technical supervision and regulatory compliance

Matthew Harrington, Professional Geologist (P.Geo.) at Mercator Geological Services Ltd., was designated as the independent qualified person responsible for validating the technical information in line with Canadian National Instrument 43-101 (NI 43-101) regulations. The Graphano Energy board, represented by Roger Dahn, approved the disclosure of these results according to current regulatory requirements.

The published estimate highlights that mineral resources do not constitute reserves and do not yet demonstrate proven economic viability. The next development steps will depend on the results of economic analyses, permitting processes, and developments in the North American graphite market.