Two of the four companies shortlisted by Great British Nuclear (GBN) have confirmed they have submitted their final offer as part of the UK’s small modular reactor (SMR) technology selection process. GE Hitachi Nuclear Energy and Rolls-Royce SMR have taken a strategic step in this procedure, which is overseen by GBN, the public body tasked with developing new civilian nuclear capacity on a national scale.

Four vendors were shortlisted last September to enter negotiations: GE Hitachi, Rolls-Royce SMR, Holtec International and Westinghouse Electric Company. In February, the companies were invited to submit final offers. GBN plans to select up to three technologies, with the aim of supporting the deployment of multiple SMR units at one or more designated sites.

Proposed technologies and potential sites

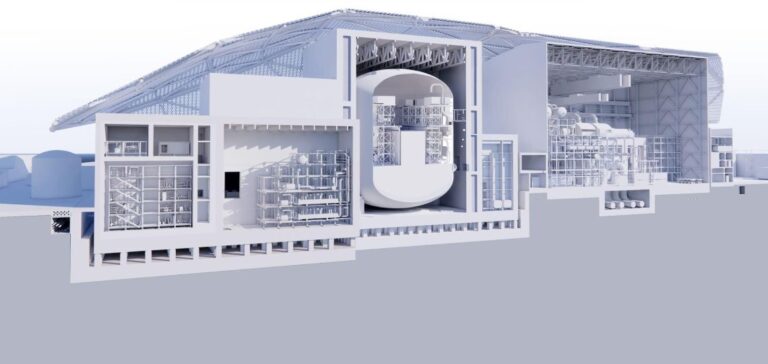

The competing designs include GE Hitachi’s BWRX-300, a 300 MWe boiling water reactor, and the Rolls-Royce SMR model, a 470 MWe pressurised water reactor. Holtec is proposing the SMR-300, also a 300 MWe pressurised water reactor, while Westinghouse is promoting its AP300, with a capacity of 300 MWe/900 MWt. Each company emphasises the robustness of their technologies, derived from existing designs, and their ability to leverage modular production methods to accelerate delivery timelines.

GBN currently owns two sites identified for SMR deployment: Wylfa in North Wales and Oldbury in South West England. However, additional locations may be selected depending on the outcome of the selection phase.

Next phase of the selection process

The announcement of the selected technologies is expected before summer. GBN subsequently plans to make a final investment decision in 2029. According to Simon Bowen, Chairman of GBN, the chosen vendors may receive financial support covering the stages of design, regulatory approval, environmental permitting and site development, as well as a potential contract for equipment supply.

Recent statements from GE Hitachi and Rolls-Royce SMR highlight the industrial scope of their proposals. The process aims to enable rapid deployment of selected technologies as part of the UK’s energy diversification strategy.