In a major strategic move, Gabon, financially backed by Gunvor Group, acquired substantial oil assets from Assala Energy for $1.3 billion. The transaction, completed on June 21, marks a decisive step for the Republic of Gabon in controlling its energy resources.

Acquisition context

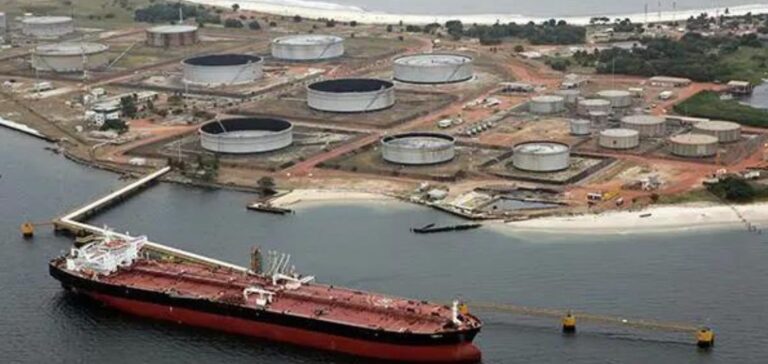

The agreement, which includes production licenses, a pipeline network and the Gamba export terminal, is of key importance to Gabon as it seeks to strengthen its position in the global oil market. Despite doubts about GOC’s (Gabon Oil Company) financial capacity to support such an acquisition, Gunvor’s financing provides a solid basis for the deal.

Details and implications of the agreement

The deal not only implies a significant increase in Gabon’s oil production, but also greater potential for state control over oil revenues. This move could significantly alter the dynamics of the energy market in the region, by giving Gabon greater autonomy in the management of its resources.

Economic outlook and risks

While this acquisition strengthens national control over strategic reserves, it also presents financial risks linked to the volatility of oil prices and Gabon’s repayment capacity. Gunvor’s financing model, offering marketing rights in exchange for funding, is a common arrangement but not without its challenges, especially in an uncertain global economic climate.

Gabon’s acquisition of Assala Energy’s assets, with the support of Gunvor, illustrates a growing trend towards state intervention in the energy industry. This operation could either stabilize domestic production in the long term, or present major financial challenges, depending on fluctuations in the global oil market. Time will tell whether this bold maneuver will translate into greater prosperity or economic challenges for Gabon.