On 15 March 2025, the French government enacted a decree allowing the use of treated wastewater in industrial and nuclear facilities. This initiative aims to reduce reliance on potable water resources by promoting alternatives for specific domestic and industrial applications.

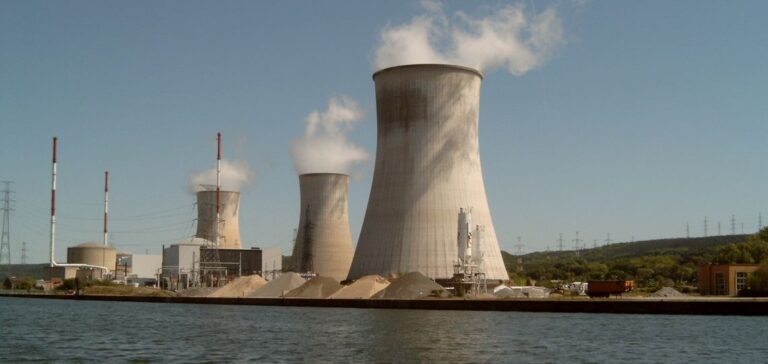

Expansion to industrial and nuclear sectors

The decree now permits the use of non-drinkable water for specific domestic applications, such as laundry washing, interior floor cleaning, excreta evacuation, decorative fountain supply, exterior surface cleaning, and irrigation of vegetable gardens and green spaces. This measure applies to classified installations for environmental protection (ICPE) and basic nuclear installations, including reactors, nuclear fuel-related facilities, and radioactive material storage.

Objectives of the Plan Eau

This initiative is part of the Plan Eau announced in March 2023 by President Emmanuel Macron, which aims to reuse 10% of wastewater by 2030. The objective is to promote water conservation in industrial and nuclear installations by preserving potable water resources and reducing withdrawals from natural sources.

International comparison

Currently, France utilises only 1% of its treated wastewater reuse (REUT) potential, whereas Israel exploits 80%, Spain 14%, and Italy 10%. This initiative could position France as a more active player in sustainable water management.

Regulatory framework

An order issued on the same day specifies quality criteria and technical conditions to be met for using these waters in ICPE and nuclear installations. This regulatory framework ensures that the reuse of treated wastewater complies with health and environmental standards.

Implications for affected sectors

Industries and nuclear sites will need to adapt their infrastructure to integrate these new non-potable water sources. This could lead to investments in suitable treatment and distribution systems while also providing opportunities to reduce costs related to potable water supply.

This initiative reflects France’s increased commitment to modernising its water resource management in alignment with international practices and current environmental imperatives.