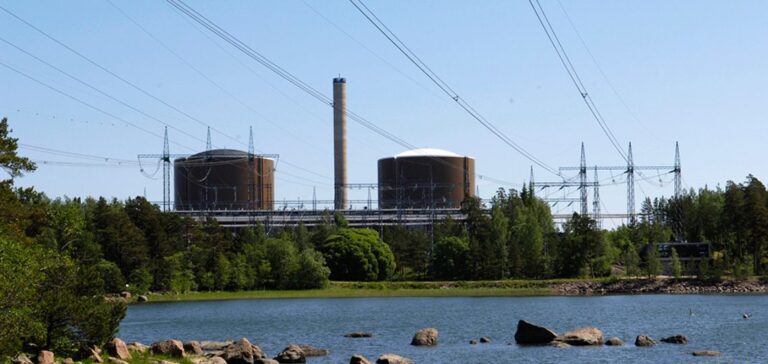

Fortum uses nuclear fuel supplied by the American Westinghouse Electric Company for its Loviisa power plant in Finland.

This change is part of a strategy to reduce its dependence on Russia.

For years, Loviisa had operated with fuel from Rosatom subsidiary TVEL, but the war in Ukraine and geopolitical tensions have prompted Fortum to reassess its sources of supply.

In August 2024, the first shipment of Westinghouse fuel was introduced, marking a turning point in the plant’s energy supply.

The use of Western fuel represents an alternative to Russian supplies, which is crucial to Finland ‘s energy security after it joins NATO in 2023.

By diversifying its sources, Fortum aims to protect itself against potential disruptions linked to Russian imports.

Dependence on a single supplier is seen as a strategic risk, and this new direction reflects a fundamental trend in Europe to reduce Russia’s influence in the nuclear sector.

European context and diversification of supplies

Fortum’s situation is part of a wider context of redefined energy strategies in Europe.

In 2023, Euratom Supply Agency (ESA) notes an increase in Russian nuclear fuel imports compared to 2021, as a result of member states’ efforts to build up stocks in the face of uncertainty.

Several EU countries, including Bulgaria, the Czech Republic, Hungary, Slovakia and Finland, operate Russian-designed VVER reactors, requiring specific fuel produced by Rosatom.

Westinghouse is currently working with most of these countries to facilitate the transition to non-Russian fuel, with the exception of Hungary, which continues to work with Rosatom.

Although Europe is making progress in diversifying its supplies, certain segments such as conversion and enrichment remain dominated by Russia.

Efforts are continuing to reduce these dependencies, but Russian predominance in these key sectors persists.

Implications for Fortum and the energy market

Fortum respects its existing contracts with TVEL, in force until 2027 and 2030, while gradually integrating American fuel.

This dual strategy aims to ensure an orderly transition while securing supply.

The choice of Westinghouse for Loviisa is not simply a change of supplier, but an approach to risk management in an increasingly complex energy environment.

Geopolitical conditions are changing, and industry players are seeking to diversify their sources to avoid future disruptions.

Using multiple suppliers also enables Fortum to benefit from better purchasing conditions and reduce its vulnerability to a single supplier.

This approach reflects a wider trend in the European energy market, where security and resilience have become priorities in the face of new political and economic realities.