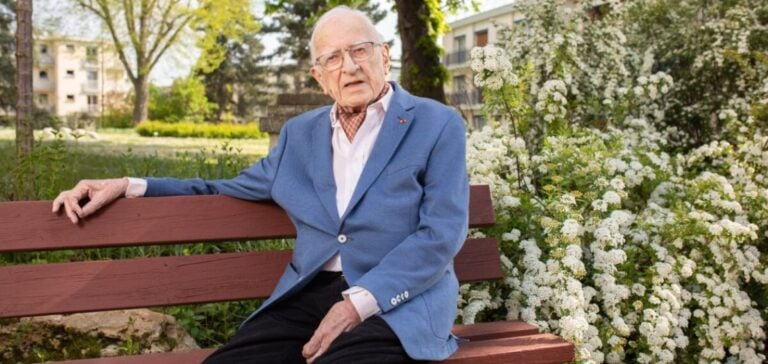

Former EDF boss Marcel Boiteux, who spent his entire career with “Electricité de France” from 1949 onwards, becoming general manager in 1967, then chairman (1979-1987), and finally honorary chairman, died on Wednesday at the age of 101, the group announced on Thursday.

Marcel Boiteux, Honorary Chairman of EDF, dies aged 101: A Key Man for Nuclear Energy

“Marcel Boiteux” passed away “late yesterday (Wednesday)”, an EDF spokesman told AFP.

A few months before the 1973 OPEC oil embargo against the United States, Marcel Boiteux had launched the slogan “All nuclear, all electric”, before the second oil shock of 1979 confirmed his option.

“A heritage to defend. Thank you,” reacted Maud Bregeon, Renaissance MP for Hauts-de-Seine and nuclear engineer, on the social network X (formerly Twitter). “The architect of a national consensus on civil nuclear power and the linchpin of the Messmer plan”, the vast nuclear power plant construction program announced in 1974, he embodied “energy à la Française”, according to the MP.

Under his impetus, the plant mobilized its technical, financial and human resources for over ten years to meet the nuclear challenge.

Marcel Boiteux, Architect of French Nuclear Energy: A Life of Challenges and Achievements

But Marcel Boiteux had to fight a very tough battle against opponents of nuclear power, and narrowly escaped an assassination attempt – a bomb exploded at the entrance to his home in 1977.

Marcel Boiteux, born into a Protestant family on May 9, 1922 in Niort (Deux-Sèvres), was the son and grandson of two graduates of the Ecole Normale Supérieure. A graduate of Sciences-Po and agrégé in mathematics, he began his career at the Centre national de la recherche scientifique (CNRS) in 1947, after a brilliant record of service during the Second World War.

Joining EDF two years later, he spent nine years in charge of the General Economic Studies Department, before climbing the hierarchical ladder: he was appointed Deputy General Manager (1967), then General Manager the same year, before becoming Chairman of the Board of Directors in 1979.

A prestigious academic career

Retired in 1987, he became Honorary Chairman of EDF. Elected to the Académie des sciences morales et politiques in 1992, Marcel Boiteux also chaired a number of organizations: Centre européen de l’entreprise publique (1982-85), Institut des hautes études scientifiques (IHES) (1985-1994), World Energy Conference (1986-89), Institut Pasteur Board of Directors (1988-1994), Fondation EDF (1987-2001).

In 2008, he became a member of the Strategic Orientation Committee of the Fédération environnement durable (FED), an association opposed to wind power. Marcel Boiteux was Grand Officer of the Légion d’honneur, Croix-de-guerre 39-45, Commander of the German Order of Merit.

Why does it matter?

Marcel Boiteux was a key player in the history of French energy, particularly in the nuclear field. His influence continued long after his retirement, and his death has prompted reflection on the future of energy in France and around the world.

His commitment to nuclear power has left a lasting imprint on the energy sector, and his legacy continues to influence energy policies today.