FlagshipONE, in Örnsköldsvi, Sweden receives final investment approval (FID) from Ørsted’s board of directors.

An ambitious project

FlagshipONE is an e-methanol project producing 50,000 tons per year. It will be Ørsted’s first commercial-scale Power-to-X installation. The company takes full ownership of the project by acquiring the remaining 55% stake from Liquid Wind AB.

It is the largest green e-methanol FID installation in Europe. In addition, FlagshipONE is expected to go live in 2025. Global shipping is a priority area for Ørsted and represents 3% of global carbon emissions.

Indeed, FlagshipONE is the first e-methanol project in Ørsted’s ambitious green fuels pipeline. The company is also developing the 300,000 ton “Project Star” in the Gulf of Mexico. The “Green Fuels for Denmark” project in Copenhagen will also produce significant volumes of e-methanol.

Industrial consistency

Currently, green fuels are more expensive in shipping than fossil alternatives. In addition, the industry needs regulatory support to stimulate green fuel. Mads Nipper, group president and CEO of Ørsted, says:

“Now more than ever, the world needs bold green energy projects to combat climate change, decarbonize hard-to-electrify sectors and ensure regional energy independence. Ørsted is committed to leading the green transformation of society, and that is exactly what we are doing by building projects like FlagshipONE. E-methanol is the best solution currently available to decarbonize hard-to-electrify sectors like global shipping, and with this first commercial-scale project, Ørsted will break new ground by advancing our industry-leading portfolio of e-methanol projects.”

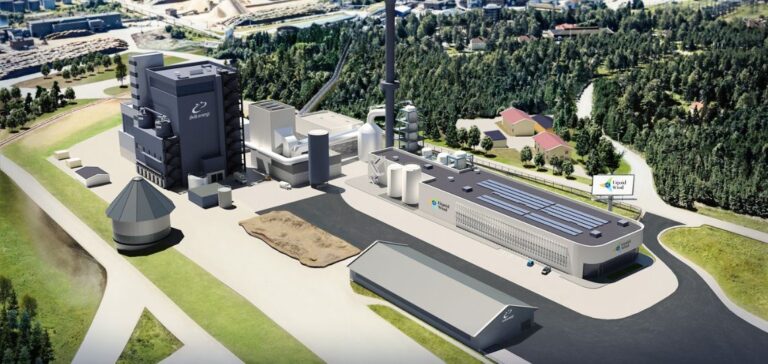

Ørsted will begin on-site construction of FlagshipONE in spring 2023. The project is located on the site of the biomass-fired combined heat and power plant Hörneborgsverket in Örnsköldsvik. Övik Energi operates the site.

FlagshipONE’s e-methanol will come from renewable electricity and biogenic carbon dioxide captured at Hörneborgsverket. The Hörneborgsverket steam, process water and cooling water project. The excess heat will be used for district heating.