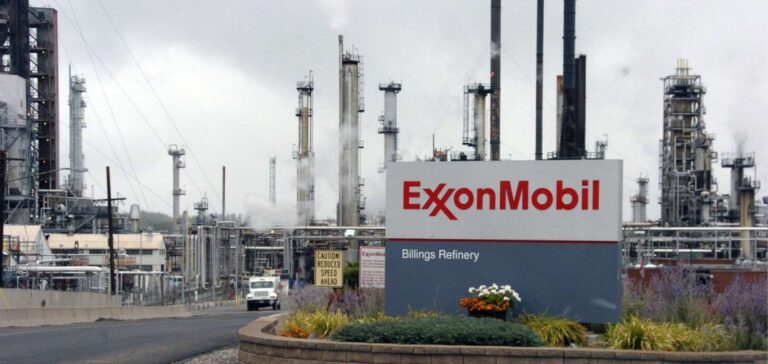

US oil and gas giant Exxon Mobil announced the acquisition of Denbury on Thursday. A U.S. company specializing in CO2 capture, valued at $4.9 billion through this all-share transaction.

The merger of ExxonMobil and Denbury: a major step towards industrial decarbonization

This acquisition “illustrates our determination to profitably grow our low-emission solutions business by offering hard-to-decarbonize industries a complete range of carbon dioxide capture and sequestration,” commented ExxonMobil boss Darren Woods, quoted in a statement.

The transaction still requires the approval of Denbury shareholders and regulatory authorities. Completion is scheduled for the fourth quarter of 2023.

At the same time, the group is acquiring a vast network of over 2,000 kilometers of gas pipelines – including almost 1,500 km for CO2 transport – in the southern United States (Louisiana, Texas, Mississippi) and ten “strategically located” onshore sequestration sites.

The combined resources of the two companies “have the potential to reduce greenhouse gas emissions by more than 100 million tons per year in one of the highest emitting regions of the United States”, commented Dan Ammann, President of ExxonMobil’s Low Carbon Solutions business.

ExxonMobil and Denbury agree to acquire oil and gas activities

ExxonMobil will also recover oil and natural gas activities located on the Gulf Coast and in the Rocky Mountain range. They represent estimated reserves of over 200 million barrels of oil.

Under the terms of the agreement between the two companies. Denbury shareholders will receive 0.84 of an ExxonMobil share for one Denbury share.

Denbury’s management examined “various options to maximize long-term value. (…) it became clear that the transaction with ExxonMobil was in the best interests of the company”, explained Denbury boss ChrisKendall, quoted in the press release.

At 13:50 GMT, ExxonMobil shares were down 1.54% at $104.93. And Denbury’s was down 1.05% at $86.83.