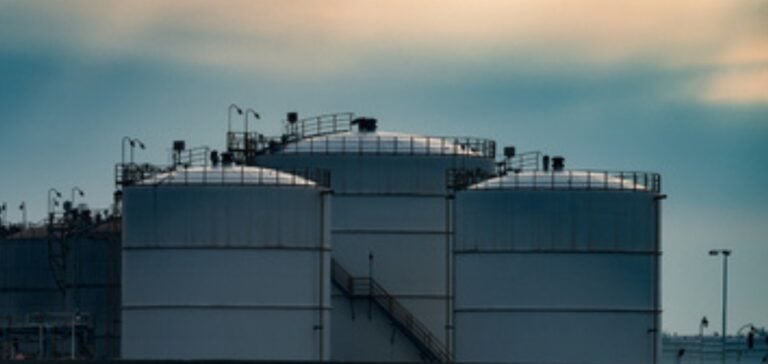

Germany plans to increase its LNG storage capacity with the installation of three new floating storage and regasification units (FRSU). Two of these, Transgas Force at Stade (7.5 Bcm/year) and Excelsior at Wilhelmshaven II (5 Bcm/year), are scheduled to be operational by November and December, according to data from S&P Global Commodity Insights. The third, Transgas Power FSRU at Mukran (7.5 Bcm/year), is scheduled to come on stream in the first quarter of 2024.

Expanding LNG capacity in Germany

Germany, which already has a combined LNG import capacity of around 18 Bcm/year from three operational FRSUs at Wilhelmshaven I, Brunsbuttel and Lubmin, is increasingly turning to LNG imports to secure its future energy supplies. In 2023, Germany imported 4.16 million tonnes of LNG, according to S&P Global data, whereas it had recorded no imports until November 2022.

This rush to deploy new LNG import facilities in Germany followed a record surge in European gas prices in 2022, as well as a sharp drop in Russian gas exports, particularly following the halt in Nord Stream deliveries. As a result, many of Germany’s energy-hungry industries have been hard hit by their dependence on gas as a raw material. “There is increased demand and a need for LNG slots from large industrial companies in Germany,” said a German portfolio manager.

Growing demand for LNG in Germany

In addition to long-term demand, today’s German FRSUs are also experiencing robust demand for their short-term usage slots. Deutsche Energy Terminal, established in January to operate Germany’s state-supported LNG import terminals, concluded the first auctions of short-term regasification capacity for the 2024 slots at the Brunsbuttel and Wilhelmshaven I terminals on October 26. All 60 slots put up for auction were sold, guaranteeing maximum capacity utilization of both terminals by 2024.

Other sources stressed that the new FRSUs would be a key factor in securing new energy supplies for Germany and the continent as a whole, while adding that they would probably not completely resolve the volatility of European gas markets.

The expansion of LNG storage capacity in Germany is an important step towards ensuring the country’s security of energy supply. However, this is unlikely to significantly alter German gas prices compared with other European hubs. The volatility of European gas markets is likely to persist, but new facilities offer interesting opportunities to meet growing demand.