China’s Envision Group has announced a billion-dollar investment in Spain to build a plant for electrolyzers, equipment used to produce green hydrogen from renewable sources.

According to a memorandum of understanding signed with the Spanish government, construction of the plant is due to start by June 2026.

The exact location has not yet been revealed, but funding will come from private partners associated with Envision.

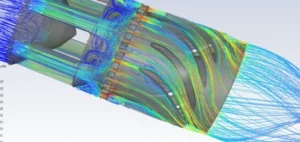

This project is part of a wider hydrogen development strategy, with the ambition of participating in the entire value chain, from the production of electrolyzers to the creation of infrastructures for the use of hydrogen in various industrial applications.

Envision is also negotiating with Spanish and European partners for additional projects, notably in the fields of e-methanol and green energy infrastructures.

Spain strengthens its position in hydrogen

Spain sees hydrogen as a strategic opportunity to diversify its energy mix and reduce its dependence on fossil fuels.

Thanks to its potential in renewable energies, particularly wind and solar, the country hopes to position itself as a European hydrogen hub.

However, the high cost of producing green hydrogen, without public subsidies, remains a major obstacle to the competitiveness of this technology.

Envision’s investment in Spain follows a previous agreement in 2022, worth 3.8 billion euros, which already included projects in the field of batteries for electric vehicles and hydrogen.

The link between this new investment in electrolyzers and the original 2022 plan is not clarified in the recent memorandum of understanding.

A growing dynamic of international partnerships

Ongoing discussions between Envision and several Spanish and European players suggest a desire to develop strategic partnerships around hydrogen and related technologies.

E-methanol projects, for example, testify to a growing interest in diversifying hydrogen applications in the chemical industry and maritime transport, sectors in which Spain and other European countries are seeking to innovate.

Investments by international groups such as Envision also demonstrate the value of diversifying sources of financing and technology in the development of new energy infrastructures in Europe.

By choosing Spain, Envision benefits from a favorable environment for renewable energies and industrial innovation.

Impact on the European energy sector

The development of hydrogen in Spain and investments by international companies are taking place against a backdrop of strategic re-evaluation of energy security in Europe.

Industry players, both public and private, must now navigate a landscape where international partnerships and technological innovation are crucial to remain competitive.

This dynamic of collaboration between Chinese and European entities around large-scale projects such as Envision could influence future European energy policy, while strengthening local industrial capabilities.

The Envision initiative, even if it is conditional on profitability and subsidies, could represent a key step towards consolidating the infrastructure needed for hydrogen in Europe.