Enphase Energy announces the acquisition of German company GreenCom Networks. This will accelerate Europe’s energy transition. Also, the collaboration of the two companies aims to satisfy a growing demand for energy technologies.

A technological improvement for both companies

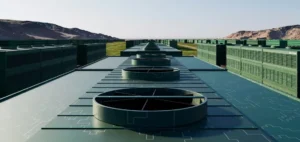

GreenCom Network is a leading player in the IoT field. It provides solutions for connecting energy devices to the home. These technologies aim at the complete electrification of homes by facilitating the convergence of several sectors such as mobility and heating with renewable energy.

The company also manages the integration of a set of devices. These include solar inverters, battery systems, electric vehicle chargers and heat pumps.

Enphase Energy is a leading provider of microinverter-based solar and battery systems. These allow the exploitation of the sun to produce, use, save and sell their own energy. To date, the company has deployed its systems in over 140 countries.

Through this acquisition, Enphase aims to expand its energy technologies. It aims to provide a complete home energy management system with GreenCom systems.

The benefits of Enphase and GreenCom technologies

In addition, the self-management of energy enabled by these devices will help homeowners save money on their electricity bills. This, along with a significant reduction in CO2 emissions while avoiding the use of fossil fuels.

Mehran Sedigh, vice president of storage for Enphase Energy, speaks about the integration of GreenCom technologies:

“The technical capabilities of the GreenCom Networks development team will help accelerate our global home energy management solutions.”

Christian Feisst and Peter Muller-Bruhl, both co-CEOs of GreenCom, see significant potential in this acquisition. They believe that it will lead to significant progress. These are in the direction of decarbonization and reduction of expenses.

In addition, both companies emphasized the aspect of dependence on fossil fuels. They rely on this context of energy crisis to propose adapted solutions by wishing to develop them globally.