ENGIE North America, a subsidiary of the French group ENGIE, and the company specialising in solar panel recycling, SOLARCYCLE, have introduced a new contractual provision called “precycling”. This innovative measure directly integrates end-of-life management of solar panels and other photovoltaic system components into Power Purchase Agreements (PPA), ahead of the effective launch of projects.

An original contractual model

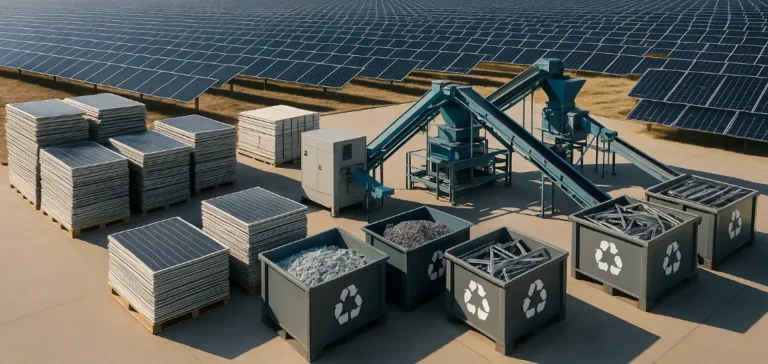

The precycling contractual provision covers four separate projects in the Midwest United States, totalling a solar energy production capacity of 375 megawatts (MW). The explicit objective of this initiative is the effective recycling of approximately one million solar panels at the end of their operational life. SOLARCYCLE specifies that this initiative could prevent approximately 21,770 tonnes of materials from being landfilled.

According to SOLARCYCLE’s estimates, these anticipated recycling measures should also prevent the emission of approximately 33,000 tonnes of CO2. All recovered materials are expected to be reintroduced into domestic supply chains, ensuring complete traceability and facilitating the renewal of components used in future energy infrastructure.

Complete traceability of materials

The project relies on a sophisticated tracking system designed by SOLARCYCLE. This technological system ensures that every panel and component covered by the contracts is effectively recycled and that the recovered materials are systematically reintroduced into domestic supply chains.

This innovative approach addresses a growing demand for circular initiatives within the energy industry, without requiring complex regulatory interventions or additional upfront payments from developers or buyers.

Industry outlook

Caroline Mead, Senior Vice President for Power Marketing at ENGIE North America, highlighted that this collaboration reflects a shared commitment to ensuring the long-term sustainability of the energy sector. “Our collaboration with SOLARCYCLE demonstrates our shared commitment towards the long-term sustainability of our industry,” she stated.

Jesse Simons, co-founder and Chief Commercial Officer at SOLARCYCLE, also commented: “ENGIE’s precycling provision sets a new precedent for the large-scale solar industry by proving that circular economy principles can be implemented simply and effectively.”

The integration of precycling into Power Purchase Agreements comes as ENGIE North America continues to expand its operations in the United States, currently operating more than 12 gigawatts (GW) of renewable energy generation and storage capacities.