The energy storage sector reached a significant milestone in 2024, raising a total of $19.9 billion across 116 deals, marking a 5% increase compared to the previous year. However, this overall rise hides a significant decline in venture capital (VC) investments, which dropped by 60% year-over-year, falling from $9.2 billion to $3.7 billion. This trend highlights a shift in how energy storage companies are financed, with a marked rise in debt financing and public market financing.

One of the main reasons for this shift is the maturation of the energy storage sector, particularly with lithium-ion battery technologies, iron-air batteries, and battery recycling. These technologies continue to attract significant investments, although the share of venture capital funding has decreased. Investors seem to prefer safer, more traditional forms of financing, such as loans and public market equity offerings, to support the rapidly expanding energy storage companies.

Venture Capital Funding and M&A Transactions

In 2024, venture capital funding primarily benefited companies specializing in lithium-ion batteries, such as Form Energy, Sila Nanotechnologies, and EnerVenue Holdings, which raised substantial sums. Form Energy successfully raised $405 million, while Sila Nanotechnologies secured $375 million. These companies continue to dominate the advanced battery market, even as venture capital funding contracts.

The increase in mergers and acquisitions (M&A) activity in the energy storage sector is also notable. In 2024, 25 companies were acquired, compared to just 15 in 2023. This trend could continue to strengthen as larger players look to enter this fast-growing sector and integrate cutting-edge technologies to stay competitive in the market.

The Rise of Debt and Public Market Financing

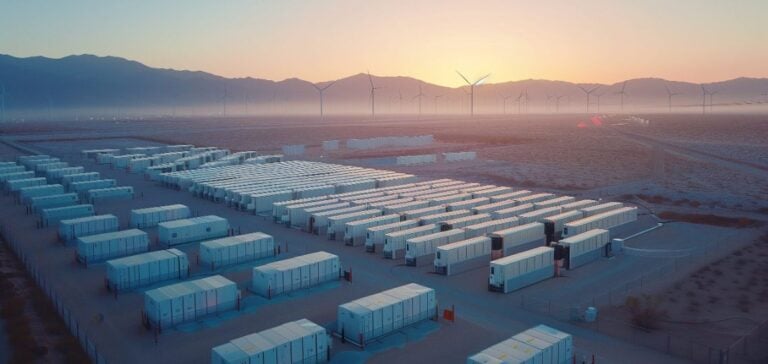

While venture capital funding shows signs of slowing, debt and public market financing have taken over, registering a 65% increase compared to 2023. In 2024, this segment raised $16.2 billion, compared to $9.8 billion the previous year. These funds are primarily used to support the large-scale development of energy storage projects, often in response to the growing demand for more efficient and affordable storage solutions globally.

Public markets represent a way for companies to raise large amounts of capital while allowing institutional investors to inject funds into large-scale projects. This trend is expected to strengthen in the coming years as the energy storage market reaches more advanced stages of development.

Outlook for the Coming Years

Looking ahead to 2025-2027, several key trends are emerging in the energy storage sector. The global market could surpass $40 billion by 2027, supported by the increasing demand for renewable energy, particularly solar and wind, and innovations in storage technologies, such as iron-air and metal-hydrogen batteries. Projections also indicate that the energy storage sector in the Asia-Pacific region, particularly in China and India, will continue to grow at a rapid pace, driven by favorable energy policies and the rising demand for renewable energy.

The evolution of financing in the energy storage sector seems to be moving towards more sustainable long-term solutions, with a combination of public, private, and debt financing. As technologies evolve, cost optimization and storage capacity management will be essential to meet the challenges posed by renewable energy intermittency and the growing demand for energy efficiency.