The southern African country of Mozambique has officially started exporting liquefied natural gas (LNG), against the backdrop of the energy crisis in Europe caused by the Russian war in Ukraine, President Filipe Nyusi announced on Sunday.

“It is with great honor that I announce the start of the first export of liquefied natural gas,” President Nyusi said in a video statement.

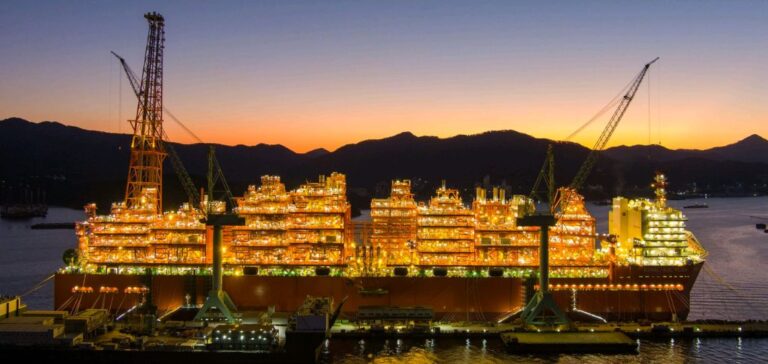

The first cargo of gas was produced at the offshore plant Coral Sul, managed by the Italian group Eni, added the head of state, welcoming that his country enters “the annals of world history.

This is the first export under a long-term purchase and sale contract with British giant BP, covering the total volumes of LNG produced in Mozambique, Nuysi said.

According to him, the country offers “a stable, transparent and predictable environment for the realization of multi-billion investments”.

The Coral Sur liquefaction plant is the first floating liquefied natural gas facility to be deployed in the deep waters off the coast of Africa and has the capacity to produce 3.4 million tons of LNG per year.

Europe’s energy security

Eni CEO Claudio Descalzi welcomed a “significant step forward” in the company’s strategy to make gas a source “that can contribute significantly to the energy security of Europe, including through the increasing diversification of supplies.

After the invasion of Ukraine, Russia significantly reduced its gas supplies to Europe. Many states are competing for access to liquefied natural gas. But this gas is much more expensive to import than the gas that used to arrive via pipelines between Russia and Europe.

Mozambique has high hopes for large natural gas deposits, the largest ever found south of the Sahara, which were discovered in the northern province of Cabo Delgado in 2010.

Once exploited, these deposits could make Mozambique one of the ten largest exporters in the world.

But the impoverished, Muslim-majority province of Cabo Delgado has been plagued by attacks by jihadist fighters affiliated with the Islamic State group that have killed nearly 4,000 people since October 2017, according to the NGO Acled, which collects data in conflict zones. The violence also caused 820,000 people to flee.

A major attack in 2021 in the coastal city of Palma forced the French giant TotalEnergies to suspend its 16.5 billion euro gas project. A project by the American company ExxonMobil is also on hold.

Since July, Rwanda and neighboring southern African countries have deployed more than 3,100 troops in support of the ailing Mozambican army.

Inland jihadist groups, however, continued to carry out sporadic attacks, adopting a more traditional guerrilla tactic.

In September, the Mozambican president said it was “appropriate” to expect a resumption of activity at future natural gas production sites in the north of the country.

The country went through a long civil war that lasted fifteen years after the departure of the Portuguese colonists in 1975 and left nearly one million people dead.

After a peace agreement in 1992, the rebellion became a political party. In 2013, the rebels had resumed arms, until a new agreement in 2019.