The rapid decline in the cost of electricity storage systems now enables continuous solar electricity generation at competitive prices in the world’s sunniest regions, according to a new study published by Ember.

Cost decline and annual reliability

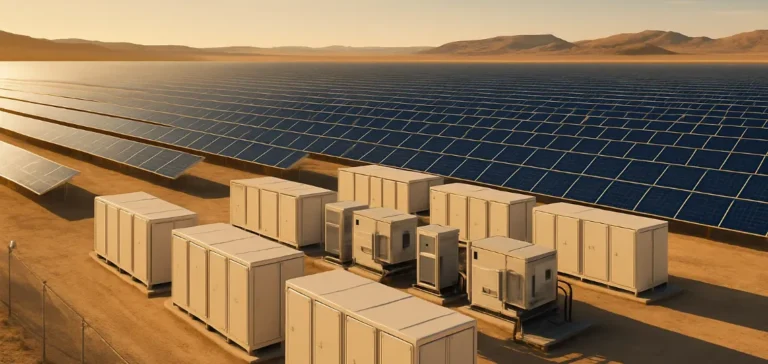

In its analysis published on June 21, Ember explained that it analysed hourly solar irradiation data from 12 major international cities. The report concluded that in particularly sunny locations such as Las Vegas in the United States, a system combining six gigawatts (GW) of photovoltaic solar panels with 17 gigawatt-hours (GWh) of battery storage capacity can now reliably deliver one gigawatt (GW) of electricity almost every hour of the year.

The global average estimated cost for this solar-storage solution is now $104 per megawatt-hour ($104/MWh), a 22% decrease from the previous year. This significant drop makes the technology more affordable than new coal-fired plants ($118/MWh) and significantly cheaper than new nuclear power plants ($182/MWh).

Global potential and regional performances

According to Ember’s report, among the cities studied, Muscat (Oman) shows the best performance, reaching availability for 99% of annual hours with this solar-storage model. Las Vegas also recorded a high result, with 97% of annual hours covered. Even in cities with slightly less solar exposure, such as Hyderabad (India), Madrid (Spain), and Buenos Aires (Argentina), coverage remains notable, between 80% and 95% of annual hours.

However, the study indicates this solution offers more limited annual coverage in less favourable environments, such as Birmingham in the United Kingdom, achieving 62% annual coverage with the same configuration.

Strategic interest for emerging economies

For Ember, these results highlight a significant economic opportunity for countries with high solar potential, primarily located in Africa and Latin America. The solar-battery combination could enable large industrial consumers, such as data centres and factories, to directly source competitively priced energy, thus reducing their dependency on expensive traditional grid expansion or reinforcement projects.

Additionally, Ember estimates that widespread adoption of this solar-battery solution could multiply existing electrical infrastructure solar capacity by up to five times, thereby deferring immediate costly investments in power grids.