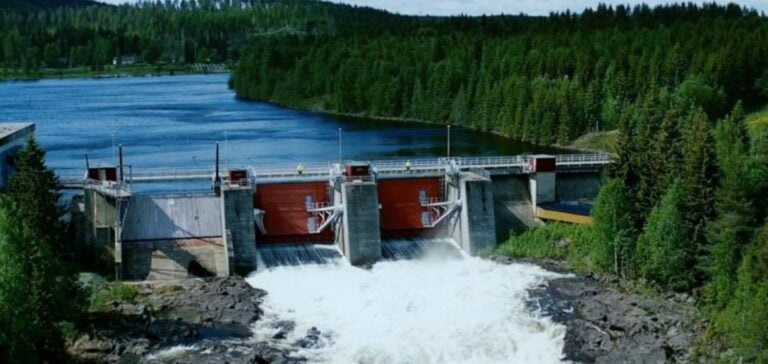

Downing Renewables & Infrastructure Trust plc (DORE) announces the acquisition of three hydroelectric power stations located on the Norasjön River in Örebro County, Sweden.

The plants, Hagby, Gyttorp and Hammarby, have a combined annual production capacity of around 7 GWh.

An increase of 0.5 GWh is planned following technical upgrades.

The total investment amounts to around £5 million.

The transaction enables DORE to expand its renewable energy portfolio by integrating these assets located in the SE3 region, a strategic Swedish market.

The storage capacity associated with the facilities offers operational flexibility, optimizing revenue management in the face of fluctuating energy demand, particularly during peak winter periods.

Plant modernization and features

The Gyttorp and Hagby plants, built in 1946 and 1952 respectively, were modernized in 2007, while the Hammarby plant, commissioned in 1982, was recently upgraded.

These improvements are designed to ensure optimum operating performance and extend equipment life.

Efficient management and regular maintenance are crucial to ensuring the profitability of these energy assets, in a market context where competitiveness is determined by the stability and efficiency of production.

These new acquisitions bring DORE’s hydropower portfolio to 37 assets, with an estimated annual production of around 222 GWh.

The addition of these facilities provides further geographic diversification and helps spread the risks associated with hydrological conditions and market price variations.

Synergies and portfolio optimization

The integration of these plants into the DORE portfolio offers opportunities for operational synergies.

DORE’s digitalization and revenue optimization initiatives aim to maximize asset profitability.

Centralized management and automation make it possible to adjust production and optimize sales on the energy market in line with price fluctuations.

This strategy responds to a desire to strengthen the portfolio’s financial resilience while minimizing operating costs.

The ability to capitalize on new asset management and monitoring technologies is part of a drive to reduce costs and improve energy efficiency.

Digitization plays a key role in this strategy, enabling more responsive and precise management of facilities, which can translate into greater profitability.

Challenges and prospects for the Swedish hydropower market

The Swedish hydropower market represents a strategic segment for investors seeking to secure long-term assets in a stable regulatory environment.

Sweden, with its strong tradition in hydropower, offers favorable conditions for the development of renewable projects thanks to its abundant natural resources and well-established market framework.

For DORE, the acquisition of Hagby, Gyttorp and Hammarby is part of a broader strategy to increase the share of hydro assets in its portfolio.

These plants will enable the company to diversify its revenue sources, while taking advantage of the hydrological characteristics and stability of the Swedish market.

Risk management and the ability to generate stable cash flows are key to attracting institutional investors and strengthening DORE’s position in the European energy market.

Hydropower remains a fundamental pillar in meeting Europe’s growing energy demand.

Hydropower assets, such as those in Norasjön, play a key role in providing flexible, adjustable energy, capable of meeting peak demand while ensuring security of supply.

By expanding its portfolio with these new acquisitions, DORE is strengthening its ability to meet today’s energy challenges, while maximizing return on investment for its shareholders.