Cowboy Clean Fuels (CCF) has finalized a $13 million Series B financing round for the commercialization of its technology enabling the simultaneous production of renewable natural gas (RNG) and the permanent sequestration of carbon dioxide.

This financing will accelerate the development of this innovative solution in the renewable energy and carbon markets.

Technology for Energy Transition

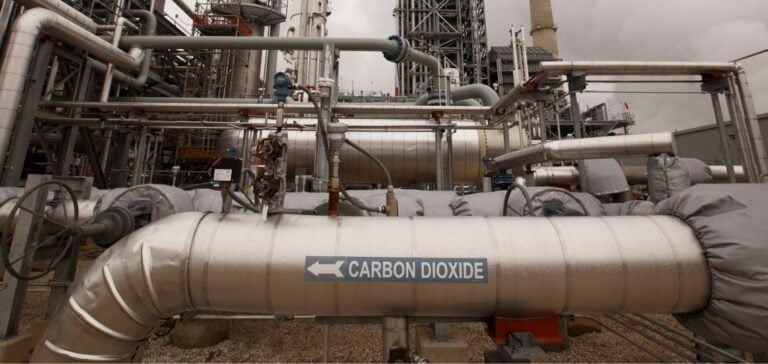

CCF uses depleted coalbed methane wells in Wyoming’s Powder River Basin to produce RNG from agricultural by-products.

These by-products are converted into CO2 and renewable methane by a biogenic process.

The technology, named “Biomass with Carbon Removal and Storage, plus Renewable Natural Gas (BiCRS+RNG)”, represents a scalable and cost-effective solution for the renewable energy sector.

The Series B financing was led by Machan Investments, with support from Syren Capital.

Combined with $7.8 million in energy matching funds from the Wyoming Energy Authority (WEA), this capital will support Wyoming’s commercial CCF project, the Triangle Unit Renewable Energy and Carbon Capture and Storage (TRECCS) Project.

A fast-growing market

The RNG market is growing rapidly in the United States, offering a cost-effective method of decarbonization for various industrial processes.

The CCF project is expected to produce around 600 million cubic feet of RNG per year at full scale.

At the same time, the CO2 sequestration market is gaining momentum, recognized as crucial to achieving Net Zero goals.

The technology developed by Dr. Michael Urynowicz and licensed by the University of Wyoming, can sequester around 180,000 metric tons of CO2e per year.

Strategic advantages

CCF technology offers a faster, less expensive solution than conventional methods.

In addition to producing renewable energy, it enables the permanent sequestration of carbon dioxide through a physical adsorption process, ensuring long-term carbon elimination.

Investment highlights

1. $20 million financing enables CCF to reach full scale by the end of 2025, potentially becoming one of the world’s largest producers of RNG credits and CO2 sequestration.

2. The TRECCS project utilizes existing assets and innovative technologies, positioning Wyoming as a leader in renewable energy and carbon capture and storage.

3. CCF technology in the Powder River Basin could make Wyoming the world’s largest producer of RNG and sequestered CO2.

Ryan Waddington, CEO of CCF, noted that this capital, in combination with matching funds from WEA, will enable the BiCRS+RNG process to be fully commercialized.

Susan Vick Dinges of Syren Capital noted that CCF’s technology comes at a critical time for the RNG and CO2 sequestration markets, with increasing demand for efficient and scalable solutions.

Dan Dinges, President of Machan Investments, expressed his enthusiastic support for the commercialization and scale-up of CCF technology.

David Kailbourne, CEO of REV LNG, LLC, added that he will join Cowboy’s Board of Directors to guide the management team to the next technological and commercial milestones.