The pressure exerted by international regulations, notably in Europe with the CSRD (Corporate Sustainability Reporting Directive), remains one of the main drivers of decarbonization in the industrial sector.

Despite this, investments in sustainable strategies are declining, reflecting the impact of geopolitical uncertainties.

These regulations are forcing companies to take concrete steps to reduce their greenhouse gas emissions and rethink their value chain.

However, it appears that many players are struggling to keep pace with these new obligations.

Indeed, 64% of companies surveyed cited tensions between major powers, notably the USA and China, or conflicts in Ukraine and the Middle East, as reasons for cutting environmental spending.

Reduced capital expenditure despite commitments

The figures are revealing: the share of revenues allocated to decarbonization initiatives has fallen from 0.92% in 2023 to 0.82% in 2024.

This downward trend worries industry observers, especially as emission reduction targets continue to tighten.

Although the majority of the world’s leading companies have affirmed their commitment to meeting their carbon neutrality targets, only 84% of senior executives say they are confident of achieving these goals by the set deadlines.

This reduction in investment contrasts with the growing need to review industrial processes and integrate innovative solutions, such as the use of renewable energies or less energy-intensive manufacturing processes.

The sector is faced with a dilemma: meeting regulatory expectations while coping with an unstable geopolitical environment and increased pressure on margins.

Consumers increasingly skeptical

As far as consumers are concerned, the perception of corporate action on sustainability remains largely negative.

In 2024, 52% of consumers consider sustainability initiatives to be more about greenwashing than real environmental commitment.

This percentage, up from 33% in 2023, shows growing mistrust, particularly among younger generations, who are more sensitive to these issues.

This mistrust could have a direct impact on companies’ brand image and attractiveness.

Executives share this concern.

Over 62% of decision-makers in the sector fear that the initiatives put in place will be perceived as insufficient or opportunistic.

This figure has exploded compared to the previous year, when only 11% of executives felt that these initiatives were poorly perceived by the public.

This trend bears witness to the growing gap between consumer expectations and companies’ ability to effectively communicate their efforts.

European companies face new challenges

In Europe, the implementation of the CSRD directive represents a major challenge for companies, which must publish their first sustainability report in 2025.

Although 75% of the companies concerned see these obligations as positive for their decarbonization strategy, a significant proportion are not yet ready to meet the new requirements.

These new standards not only imply greater transparency, but also greater investment in data collection and compliance.

In addition, the rise of European regulations in the energy sector is forcing companies to review their entire processes.

This includes adjustments in the supply chain, but also in production methods and resource management.

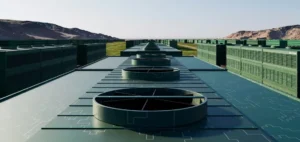

Water management, for example, has become a major issue for 75% of companies in 2024, compared with 55% in 2022, thanks in part to these new regulations.

These measures also reinforce the need for companies to train their employees in these issues, with 73% declaring that they have set up specific training programs.

A slow but necessary adaptation

The industrial sector must adapt to these rapid changes while juggling complex economic and geopolitical priorities.

Companies must meet increasingly stringent regulatory obligations, while trying to maintain profitability in an unstable environment.

Geopolitical tensions, particularly between the USA and China, as well as ongoing conflicts in Ukraine and the Middle East, directly affect companies’ ability to invest in sustainable solutions.

Indeed, supply chains and raw material costs, already under pressure, are feeling the effects of this global instability.

This has the effect of slowing down certain projects that are crucial to achieving the climate targets set by international agreements.

The use of green technologies, renewable energy and energy efficiency are levers which, if properly employed, will enable emissions reduction targets to be met, despite the headwinds.