Chinese independent refiners, which heavily rely on Iranian oil imports, anticipate a reduction in imported volumes following the intensification of international sanctions. Despite these adjustments, industry sources believe that significant supply interruptions are unlikely in the short term.

Analysts from S&P Global Commodity Insights have indicated that the situation remains stable, although tensions in the Middle East could pressure oil volumes and prices. Major Chinese refiners are closely monitoring the conflict’s developments but have not yet taken immediate measures to secure alternative supplies.

Impact of Reinforced Sanctions

Stricter sanctions imposed by the United States on Iranian oil could change the import landscape for Chinese refiners. A Beijing-based trading official emphasized that any military response from Israel could also influence Iranian exports, whether through attacks on oil infrastructure or increased pressure to tighten sanctions.

A senior trader based in Singapore added that the United States is likely to control the situation to prevent a rally in oil prices, which the US prefers not to see. This American intervention is perceived as a crucial stabilizing factor for the global oil market.

Strategies of Independent Refiners

Despite the possible reduction in Iranian imports, independent refiners in China have not yet activated emergency plans to diversify their supply sources. A source from Shandong indicated that strict enforcement of sanctions could alter this outlook, especially if the United States decides to sanction more financial institutions facilitating Iranian oil transactions.

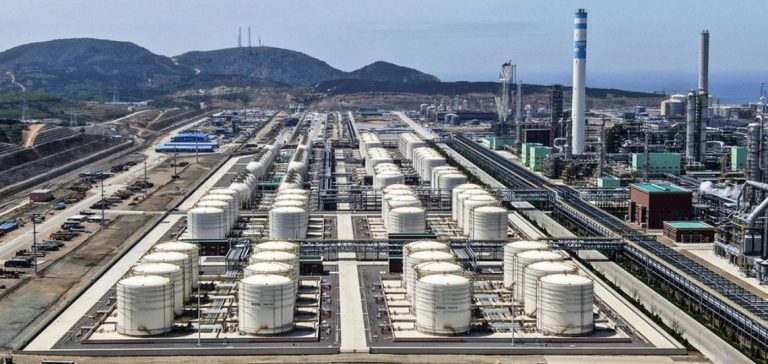

Since the reimposition of sanctions on Iran in 2018, Chinese independent refiners have been the primary buyers of Iranian crude, also depending on Russian and Venezuelan crudes, which are generally cheaper than non-sanctioned alternatives. Transactions in Chinese yuan through local banks offer additional flexibility in these exchanges.

Perspectives of the Oil Market

Data from S&P Global Commodities at Sea reveals a significant drop in Iranian oil exports, reaching 237,000 barrels per day in the week ending October 6, the lowest weekly total in two years. This contraction is attributed to reduced offers on the market, exacerbated by persistent geopolitical tensions.

Sources indicate that offers for Iranian light crudes have narrowed their discount compared to ICE Brent futures, dropping from $4-4.5 per barrel in September to $3.5 per barrel in October. Similarly, discounts for Iranian heavy crudes have tightened from $7.5-8 per barrel to $6.5-7.5 per barrel.

Alternatives and Supply Flexibility

In response to decreased Iranian supplies, Chinese refiners could increase purchases of Russian crudes, notably ESPO (Eastern Siberia-Pacific Ocean). December ESPO cargo loadings have not yet been finalized, though a slight price decrease is anticipated compared to November.

Additionally, refiners have not entirely suspended the purchase of imported fuel oil, which remains a viable feedstock option. However, expected changes to tax regulations on fuel oil and bitumen blends could increase the tax burden on independent refiners, potentially impacting their refining and profit margins.

China’s Ministry of Foreign Affairs has called on leading influential countries in the region to play a constructive role in preventing further escalation. Mao Ning, a spokesperson for the ministry, expressed China’s deep concern over the turbulent situation in the Middle East and called on all parties to act responsibly to maintain regional peace and stability.