Chinese manufacturers specialising in wind, solar, and energy storage have significantly increased their international footprint in 2024, according to analysis by Wood Mackenzie. Thirty-five new factories have been inaugurated outside China this year, bringing the total number of overseas industrial sites to 114, mainly in the Middle East, Asia-Pacific and Europe. This strategy aims to bypass the rise in customs duties and trade restrictions imposed by numerous foreign markets.

Global expansion in response to protectionist measures

According to Wood Mackenzie data, exports of Chinese renewable sector products rose by 20% in 2024, despite more than 20 markets implementing regulatory barriers. Faced with customs tariffs as high as 696% on certain solar panels, Chinese manufacturers are shifting their strategy towards local production, in order to meet local content requirements while retaining access to key markets. Wind turbine export volumes increased by 72%, while solar modules and batteries saw growth of 11% and 28% respectively.

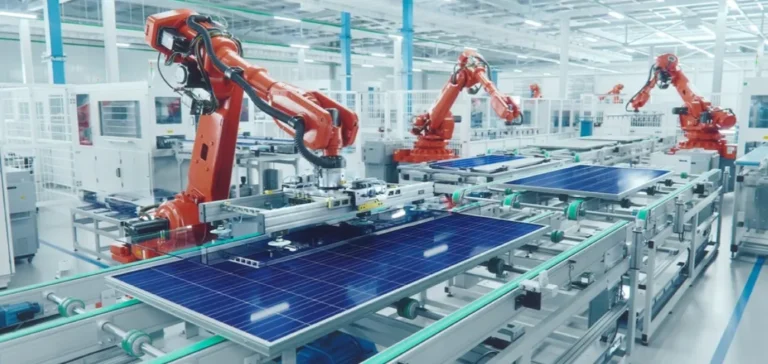

Industrial dominance and competitive gap

Wood Mackenzie notes that China controls more than 80% of global capacity for wind turbine, solar panel and energy storage battery production. This industrial leadership translates into substantial price differences: wind turbines manufactured by Chinese companies outside China are on average 28% cheaper than their Western equivalents, while the gap reaches 4% for solar modules and 31% for batteries. This aggressive pricing policy makes Chinese products attractive to global developers seeking competitive solutions.

Belt and Road Initiative and growing influence

Investment within the Belt and Road Initiative framework has intensified, with 369 international energy projects carried out between 2015 and 2024, representing 34% growth over ten years, according to the Wood Mackenzie report. Projections suggest that China could control nearly 80% of solar and wind capacity in the main markets targeted by this initiative by 2030. Investments are now focused on the Middle East, Asia-Pacific and the Caspian region, transforming these areas into industrial centres and distribution hubs for both local and global demand.

Deployment models and supply chain adaptation

The report identifies four economic models enabling Chinese groups to strengthen their presence: creation of subsidiaries, direct investments, partnerships with Western manufacturers or white-label production. This diversification helps to circumvent protectionist mechanisms while maintaining control over logistics chains. Countries with stable political environments in Asia, the Middle East and Latin America attract the majority of new facilities, while Europe is becoming less attractive due to regulatory complexity and high entry costs.

Increased competition and margin pressure

Despite higher export volumes, Wood Mackenzie notes a 13% drop in revenues from Chinese renewable equipment exports in 2024. Sales of solar modules fell by 29% and those of batteries by 5%, as a result of heightened competition and falling market prices. National policies such as the European Union’s Net Zero Industry Act or the United States’ Inflation Reduction Act are, according to the report, helping to accelerate the international deployment of Chinese manufacturers, who are adapting their supply chains to establish themselves in a competitive and fragmented environment.

The increasing sophistication of Chinese industrial strategies and the reorganisation of value chains reflect the sector’s rapid transformation, as global markets seek to respond to competitive pressure and local requirements.