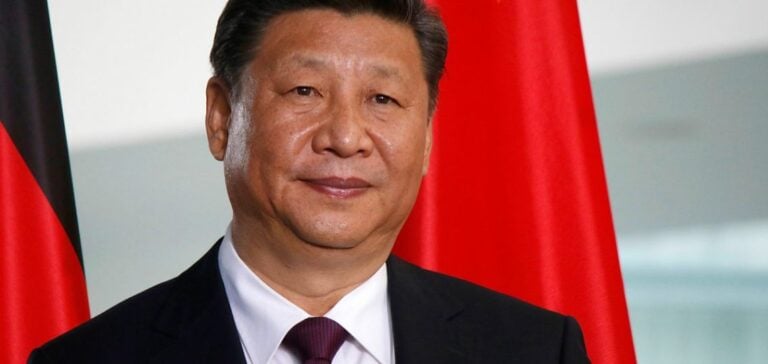

China, the world’s largest emitter of greenhouse gases, has expressed its intention to revise upward its climate targets during the 29th United Nations Climate Change Conference (COP29) in Baku, Azerbaijan. Vice Premier Ding Xuexiang, representing President Xi Jinping, confirmed that China aims to achieve carbon neutrality before 2060 while enhancing its financial contributions to climate action.

During his speech, Ding Xuexiang specified that China’s next submission of Nationally Determined Contributions (NDCs) for 2035 will encompass all economic sectors and include all greenhouse gases, surpassing the current focus on carbon dioxide (CO2). These updated targets are set to be submitted to the United Nations by 2025.

Strengthening NDCs and Climate Leadership

NDCs, periodically submitted by signatories of the Paris Agreement, outline detailed plans for reducing greenhouse gas emissions. China’s commitment to covering all sectors and greenhouse gases represents a significant shift, signaling an alignment with more ambitious global efforts. This move comes as China faces increasing pressure from developed nations to peak emissions before 2030.

Simultaneously, the vice premier reiterated China’s stance that developed nations must play a leading role in global climate financing. However, his message at COP29 reflects a notable shift by indicating China’s increased participation in this domain.

Climate Financing: A First Assessment of China’s Contributions

For the first time, China has disclosed its historical contributions to climate financing. Since 2016, the country has mobilized and provided over 177 billion yuan ($24.5 billion) to support developing countries in combating climate change. This equates to an annual average contribution of $2.7 billion, although it remains below the levels achieved by developed nations. By comparison, industrialized nations collectively contributed $115.9 billion in 2022, with $5.8 billion provided by the United States.

This statement marks a significant turning point, as Beijing had previously avoided publicly disclosing its climate financing figures. This cautious approach reflected China’s view that developed nations should exclusively bear responsibility for such funding.

Debates on Expanding the Contributor Base

COP29, described as the “Finance COP,” focuses on establishing a New Collective Quantified Goal (NCQG) for climate financing. This framework will replace the $100 billion annual target set under the Paris Agreement. A major question remains under discussion: should large developing economies, such as China, be included among regular contributors to global climate financing?

While Ding Xuexiang did not detail the methodology used to estimate China’s contributions, his intervention paves the way for discussions on potentially redefining the financial responsibilities of emerging economies in the fight against climate change.

With its new climate and financial ambitions, China seeks to strengthen its role in global climate governance while emphasizing the need for an equitable distribution of responsibilities between developed and emerging economies.