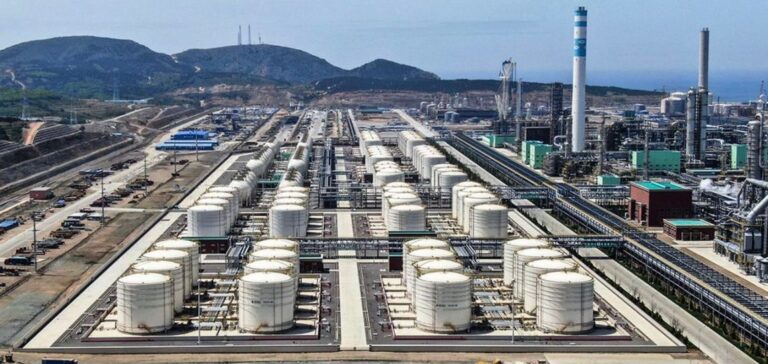

China may increase refined fuel export quotas for this year. In fact, this could greatly benefit the Chinese economy. However, the government has not yet made a decision and is still considering the issue.

China plans to increase exports

The market is following the issue closely. The market expects China to release a 5th batch of fuel export quotas. This could reach 15 million tons for the rest of 2022. This would be the largest batch in 2022. If the government chooses this option, it would boost Chinese exports.

The refiners’ proposal follows a call from the government to boost trade at a time when China’s exports are losing momentum. As a result, some refiners are preparing to increase production to take advantage of an increase in the export quota.

According to sources, China plans to extend the proposed volume until next year. Thus, the aim is to mitigate its impact on world markets and to avoid a sharp drop in prices.

The National Development and Reform Commission met with the country’s major refiners. However, to this day, the issue is still being studied. However, the meeting did provide an opportunity to take stock of the activities of Chinese refineries. In addition, the global oil market outlook for 2023 was discussed.

One source states:

“The government believes that domestic refiners have operated at low levels this year due to weak domestic demand and the negative impact of COVID controls. The quota increase could help boost overall exports and also help refiners increase production.”

A questionable volume

Indeed, global oil markets have been supported by the reduction in Chinese exports. In Asia, the volume of export quotas has led to a collapse in refiner margins.

In fact, the volume proposed by China represents a 63% increase over the 24 million tons reported for 2022. This volume would then be too large. This may impact refiners’ margins.

A Beijing-based state oil official is concerned:

“This advertised size is simply not feasible. Refiners need two to three months to source crude oil, so you risk missing the most favorable window for exports.”

In addition, crude oil and refined product inventories must be taken into account. According to this source, they are “lower than normal”.

The Chinese Ministry of Commerce and NDRC did not respond to requests for comment.