Carbonova, a Calgary-based company specialising in the valorisation of greenhouse gas emissions, has secured $3.20mn (4.38mn CAD) in funding to build the first commercial demonstration unit for carbon nanofibers in Canada. This funding comes from the Advanced Materials Challenge programme, an initiative supported by the government of Alberta and the organisation Emissions Reduction Alberta (ERA). The objective is to stimulate the sector for materials derived from the transformation of carbon dioxide (CO₂) and accelerate the creation of specialised jobs.

Industrialisation and economic impact

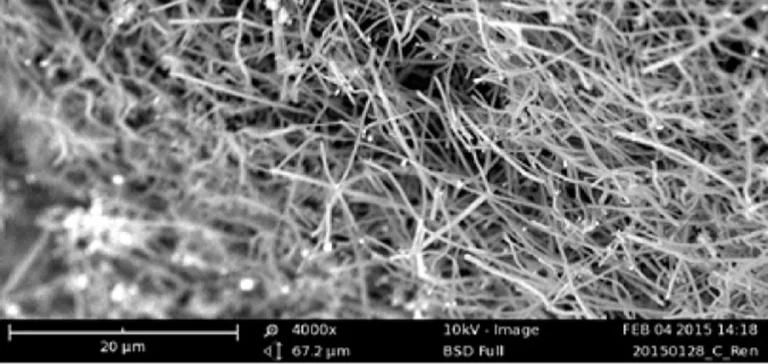

According to estimates provided under the programme, all funded projects are expected to generate more than $170.44mn (233mn CAD) in economic impact by 2027 and create 1,600 jobs in Alberta. Carbonova is developing a patented catalytic technology that converts CO₂ and methane into high-performance carbon nanofibers for use in batteries, plastics, and construction sectors.

The future Commercial Demonstration Unit (CDU) will be designed to produce 25 tonnes of carbon nanofibers per year while utilising more than 50 tonnes of CO₂. This funding covers the detailed engineering phase, the purchase of equipment, and the start of construction for the pilot site.

Strategic partnerships and market outlook

Carbonova’s industrial strategy aims to reduce production costs and carbon footprint compared to conventional materials such as carbon black, graphite, or carbon nanotubes. The company has begun negotiations for offtake agreements with industrial players in the batteries, composites, and construction sectors to demonstrate the commercial viability of the technology.

Several joint development partnerships are also underway with international players, supporting Carbonova’s position within the advanced materials sector. The development model includes a pilot phase in Calgary ahead of a global deployment based on construction, operation, and licensing.

The project, supported by industrial clients and public institutions, marks a step towards the production of low-carbon footprint carbon nanofibers from CO₂, in a rapidly evolving international market.