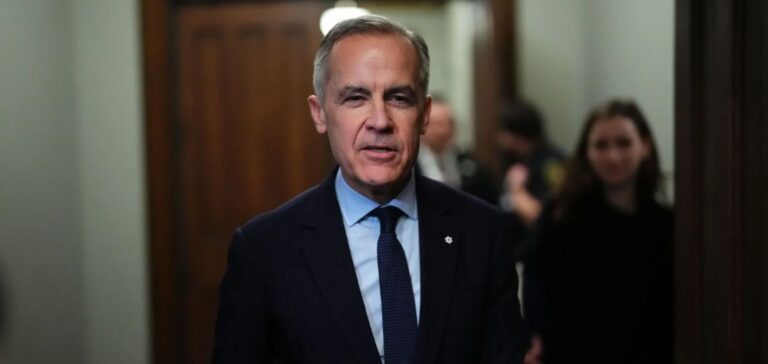

Canadian Prime Minister Mark Carney recently announced a strategic initiative aimed at expanding the country’s oil infrastructure toward the Arctic, paving the way for direct oil exports to European and Asian markets. This decision comes as the United States, Canada’s primary trade partner, threatens to impose tariffs of up to 25% on certain Canadian exports. The plan specifically includes developing pipelines connected to deep-water ports located in the Arctic, providing an alternative to an increasingly uncertain U.S. market. Carney emphasized the need to establish new trade corridors to secure the nation’s economic future.

Trade Tensions Context

This strategic shift occurs following a series of protectionist measures proposed by the administration of former U.S. President Donald Trump, measures likely to directly affect Canadian exports, including crude oil. Currently, over 90% of Canadian oil exports are directed to the U.S. market, making Canada’s economy particularly vulnerable to American political fluctuations. In response to these challenges, Ottawa aims to establish direct and sustainable trade links with other major trading partners. European markets, particularly Germany and France, have been identified as priority targets, alongside China and Japan in Asia.

Carney’s announcement is not Canada’s first attempt at diversifying its oil markets, but it powerfully reactivates several projects that had been paused or canceled due to economic or regulatory factors. The Liberal government now intends to accelerate the construction of infrastructure considered essential for long-term economic stability. Among these projects, the development of new logistical platforms in the Arctic stands as a cornerstone of this export strategy.

Reviving Major Oil Projects

Parallel to Carney’s initiative, the leader of the Conservative opposition, Pierre Poilievre, also proposes reviving major national energy projects, such as the Energy East pipeline (1.1 million barrels per day), linking Alberta to the Atlantic coast, and the Northern Gateway pipeline (520,000 barrels per day) toward the Pacific coast. Conservative proposals focus more on infrastructure already known but suspended, rather than entirely new ventures. This stance reflects rare consensus between Canada’s two leading political parties, underscoring a broad acknowledgment of the necessity to reduce the country’s dependence on the United States.

However, these ambitions will not be without obstacles. Pipeline construction to remote regions, such as Canada’s Arctic, entails high costs and extended timelines. Moreover, Canadian oil must compete in a global market already heavily contested by Middle Eastern producers, notably Saudi Arabia, as well as increasing supply from American producers to European markets.

Economic and Geopolitical Challenges

The realization of these projects will significantly influence future trade relations between Canada and Europe. Currently, the European Union actively seeks to diversify its energy supplies to reduce dependence on Russia and the Middle East. This situation presents Canada with a potential opportunity to become a key player in Europe’s energy supply, thus strengthening economic ties with partners considered stable and reliable.

These major energy projects could also affect geopolitical dynamics in the Arctic, a strategic region coveted by several global powers. Canada must navigate these complexities while developing its new oil infrastructure—an economic priority for Mark Carney’s government and any potential successors.