The Canadian federal government has identified five major industrial projects eligible for accelerated approval processes, as part of efforts to strengthen the country’s economic independence. The move comes as Canada seeks to reduce its reliance on the United States amid increasing tariff pressure.

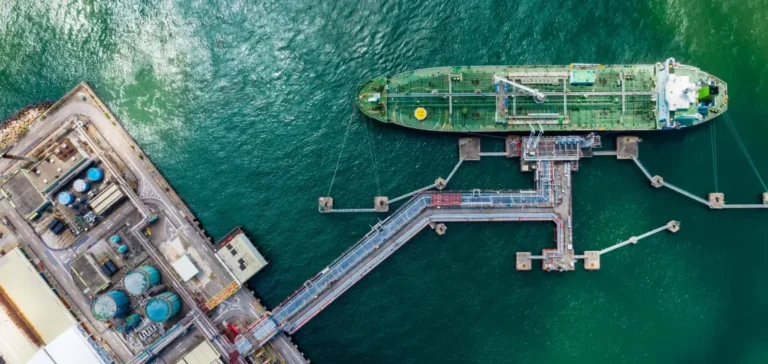

Among the selected projects is the expansion of the LNG Canada liquefied natural gas (LNG) facility in British Columbia. Led by Shell, the project aims to double the site’s current production capacity. The government intends to facilitate a swift increase in LNG exports to Asia, bypassing the more trade-sensitive North American markets.

Mining and nuclear energy included in national priorities

Two mining projects are also included on the fast-track list. These are the expansion of the Red Chris gold and copper mine operated by Newmont, and the construction of a new copper mine in Saskatchewan by Foran. These initiatives are part of Canada’s strategy to secure supplies of critical minerals, considered essential for industrial and energy supply chains.

In parallel, a small modular nuclear reactor (SMR) project in Ontario has been selected, reflecting an intent to further integrate this technology into the national energy mix. The facility would aim to strengthen low-emission electricity generation while improving grid resilience.

Port infrastructure and simplified regulatory framework

The expansion of the Montreal container port terminal rounds out the list of projects. This extension is intended to support growing maritime trade and relieve pressure on existing infrastructure. The federal government plans close coordination between relevant ministries to speed up environmental assessments, permitting, and consultation processes.

A major projects office has been established to oversee these procedures, tasked with significantly reducing administrative delays. According to authorities, it previously took up to ten years to secure all necessary approvals for mining or energy developments. The reform aims to cut these delays to levels aligned with economic and industrial demands.

Canadian Prime Minister Mark Carney stated that the country must recover its ability to deliver large-scale infrastructure quickly. “We used to build big things, and we used to build them quickly. It’s time to get back at it,” he said during a televised press conference.