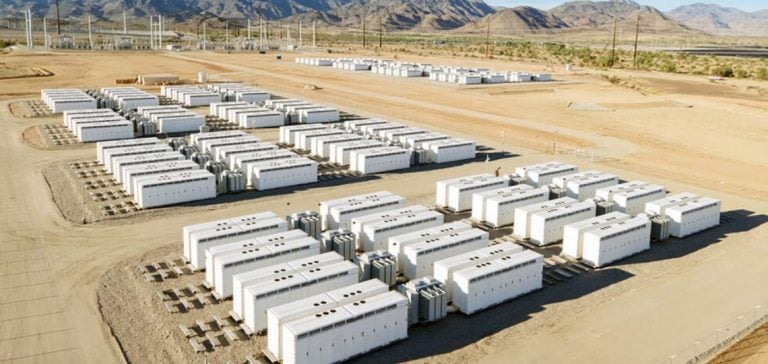

California has significantly increased its battery storage capacity, rising from 10 GW in early 2024 to 13.391 GW in October, representing a 30% increase in just six months, according to a statement from Governor Gavin Newsom’s office.

This rapid progression makes California the national leader in battery energy storage, with nearly double the capacity of any other U.S. state. This expansion is crucial to achieving the state’s ambitious climate goals and maintaining grid stability in the face of challenges posed by extreme weather conditions.

Accelerated Expansion of the Battery Market

Annie Gutierrez, senior research analyst at S&P Global Commodity Insights, stated that California’s battery market is rapidly growing and is expected to continue growing through the end of 2024 and into 2025. “We are expecting around 4-4.5 GW of additions in 2024 and a similar amount in 2025,” she explained. “Batteries have played a large role in meeting the evening peak load so far in 2024 and will continue to do so and take some pressure off of gas and imports.”

Support Initiatives and Programs

A recent state agency report revealed that the load-serving entities of the California Public Utilities Commission have 7.5 GW of storage and hybrid capacity under contract, set to come online between the fourth quarter of 2024 and 2027, Scott Murtishaw, executive director of the California Energy Storage Alliance, told S&P Global Commodity Insights on October 16.

“By adding this storage capacity, California is strengthening its resilience against extreme heat waves without resorting to demand conservation,” he added. “With the need to retire thousands of MW of old coastal gas-fired power plants and to meet the growing demand from data centers and electrification, California must maintain this sustained pace of energy storage development.”

Grid Management and Stabilization

The California Independent System Operator (ISO), which manages the flow of electricity for about 80% of California and a small part of Nevada, surpassed 10 GW of battery capacity in early October and has over 73 GW of storage capacity in its interconnection queue, with over 8 GW that have already signed interconnection agreements.

The increase in battery storage is a key component of Newsom’s energy roadmap to achieve a 100% clean electric grid. The governor’s office stated that the state is projected to need 52 GW of storage capacity by 2045 to meet these goals.

Demand Side Support Programs

The Demand Side Grid Support (DSGS) program of the California Energy Commission has enrolled 515 MW of capacity, including the world’s largest storage virtual power plant, further enhancing grid reliability. Launched in August 2022, the DSGS is part of California’s Strategic Reliability Reserve, providing backup energy resources in case of grid stress during extreme events.

Siva Gunda, vice-chair of the Commission, stated on October 15: “As the effects of climate change become more pronounced, innovative programs like DSGS provide a critical buffer for ensuring the reliability of California’s electrical grid while reducing emissions.”

Participants in the program are compensated based on the net load reduction they provide, with some earning up to $2 per kilowatt-hour of energy shared with the grid. The virtual power plant, which exceeds 200 MW of capacity, utilizes a network of customer-owned battery storage systems, typically paired with solar installations, to supply energy back to the grid.

Future Prospects

With the planned commissioning of new storage capacities and the continuation of support programs, California is well-positioned to achieve its energy and climate goals. The increased storage capacity will allow for better management of demand peaks and reduce reliance on fossil energy sources, contributing to a more sustainable and resilient energy future.