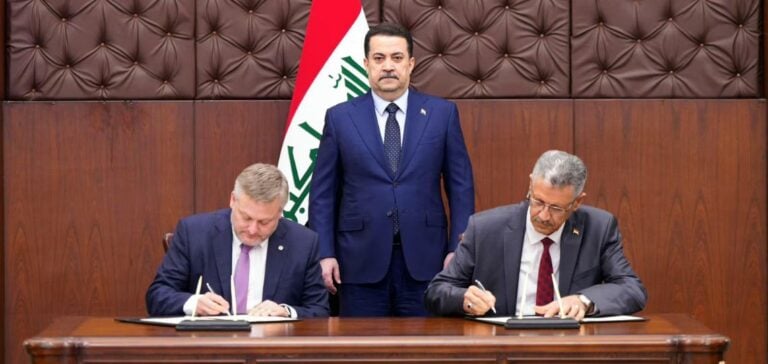

BP has signed a preliminary agreement with the Iraqi government to develop the Kirkuk oil fields, marking its return after a five-year absence.

This agreement is part of a new contractual approach in which profits will be shared between the British company and the Iraqi state, in place of the traditional service contracts that had kept the oil majors away from the country.

This new strategy responds to Iraq’s desire to increase its oil production while making its contracts more attractive to foreign investors.

The agreement, which covers four oil and gas fields, including Kirkuk, aims to revitalize a key region for Iraq’s oil economy.

Under-exploited production potential

The Kirkuk oil fields, discovered in 1927, contain an estimated 9 billion barrels of recoverable oil.

At present, production is running at around 245,000 barrels a day, far from its maximum potential.

BP plans to modernize existing infrastructure and build new facilities to stabilize and increase production.

Control of the Kirkuk region has been the scene of geopolitical tensions in recent years, negatively influencing oil operations.

However, with the restoration of control by the Iraqi central government in 2017, followed by the resumption of studies by BP, the conditions appear ripe for an effective resumption of operations.

Strategic prospects for Iraq and BP

The adoption of the profit-sharing model marks a turning point in the management of Iraq’s oil resources, making it possible to offer more competitive terms to investors.

By re-engaging in Iraq, BP is confirming its interest in a high-potential market, while responding to new contractual expectations that could redefine relations between the Iraqi government and international oil companies.

BP’s return could serve as an example for other major companies, encouraging renewed foreign investment in Iraq’s energy sector.

Finalization of the agreement is scheduled for early 2025, heralding a period of renewal for the Kirkuk oil fields and an increase in domestic production capacity.