The autonomous region of Iraqi Kurdistan recently signed two major agreements with American firms WesternZagros and HKN Energy, during an official visit to Washington by the Kurdish Prime Minister, Masrour Barzani. These contracts involve the exploitation of extensive gas and oil reserves located within the Kurdish region, representing potential investments worth tens of billions of dollars. However, Baghdad maintains that these agreements violate Iraq’s national energy sovereignty, thereby reigniting longstanding tensions between the central government and Erbil.

Baghdad’s Legal Action

Reacting swiftly to these announcements, the Iraqi government has filed a lawsuit with the al-Karkh Commercial Court in Baghdad to legally invalidate the contracts signed by the autonomous Kurdish region. The Iraqi Ministry of Oil asserts that these contracts contravene the federal constitution, which stipulates that the management and exploitation of oil and gas resources fall exclusively under the authority of the central government.

More specifically, Iraqi authorities are contesting a contract with WesternZagros for the exploitation of the Topkhana block, which, combined with the adjacent Kurdamir block, contains approximately 5 trillion cubic feet of natural gas and 900 million barrels of crude oil. The second agreement, reached with HKN Energy, aims to develop the Miran gas field, estimated at nearly 8 trillion cubic feet of natural gas. The cumulative economic potential of these two agreements could reach around 110 billion dollars over their lifespan.

United States Position

In response to this legal action, the United States has publicly expressed support for the agreements reached between the American firms and the Kurdish regional government. The spokesperson for the U.S. State Department, Tammy Bruce, has called upon Baghdad and Erbil to cooperate in order to swiftly increase Iraq’s domestic natural gas production. According to her, these economic partnerships benefit both American interests and Iraq’s energy independence and prosperity.

American diplomacy emphasizes the necessity of a strong and economically resilient Kurdish region within a stable federal Iraq, safeguarding strategic interests of both nations in the Middle East. Thus, Washington openly favors enhanced cooperation over continued judicial and political tensions.

A Longstanding Conflict Rekindled

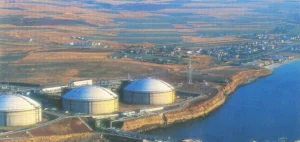

Tensions surrounding resource management between Baghdad and the Kurdish autonomous region are far from new. For several years, Kurdistan exported its oil directly via Turkey, using the Ceyhan oil terminal, without prior approval from the Iraqi central government. However, international arbitration favoring Baghdad had halted these exports, compelling Kurdistan to redirect its sales through Iraq’s national oil company.

Despite these previous judicial rulings, the Kurdistan regional government defends the full legality of the new contracts, asserting they contain no legal weaknesses and comply with standardized international practices. Furthermore, Erbil highlights that the involved companies already have extensive experience exploiting regional resources.