Aramco launches into renewable energies and invests in its largest solar project.

Aramco acquires 30% stake in 1.5 GW solar project

The Saudi company joins forces with ACWA and the Fonds d’Investissement Public (FIP), acquiring 30% of Sudair One Renewable Energy Co.

ACWA and FIP will each hold a 35% stake in the project.

This is Aramco’s first investment in the PIF’s renewable energy program.

The Sudair solar photovoltaic plant, worth $907 million, is the first project in the FIP program.

It aims to support Saudi Arabia’s energy transition by contributing 70% of the country’s renewable energy.

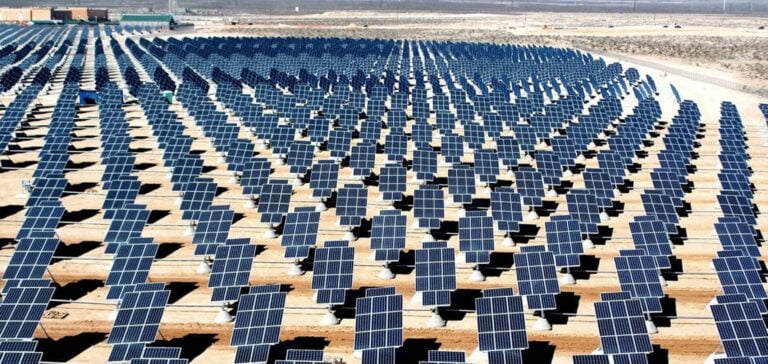

The project is planned for a 30.8 km2 site in Riyadh province.

This area will be used to install the 1.5 GW plant, along with inverters, single-axis trackers and other necessary equipment.

To date, the planned distribution tariff is $12.39/MWh.

Sudair contributes to Saudi Arabia’s energy transition

“While hydrocarbons will continue to represent an essential part of the energy mix for decades to come, renewable energies such as solar have an important role to play in helping to meet global climate goals,” says Mohammed Al Qahtani, Senior Vice President of Downstream at Aramco, in a statement.

“Sudair will support Saudi Arabia’s ambition to generate a portion of the nation’s electricity needs from renewables by 2030, and is one of many low-carbon energy options deployed by Aramco.”

Mizuho Bank, Riyadh Bank, Korea Development Bank, APICORP, Al-Rajhi Banking & Investment, Standard Chartered Bank, are participating in the project financing.

Bank Al-Bilad, Saudi British Bank and SMBC International are providing equity bridge financing.

Larsen & Toubro has signed the EPC agreement for the construction of Sudair Solar PV in April 2021.

Aramco strengthens its renewable energy partnerships

The state-owned company has signed a 25-year power purchase agreement for Sudair with Saudi Power Procurement Co.

According to ACWA, the tariff for this agreement is one of the lowest in the world for solar photovoltaic projects.

The project will be able to power 185,000 homes, while offsetting around 2.9 million tonnes of emissions per year.

“This landmark renewable energy project is an important milestone and a key part of PIF’s commitment to developing 70% of Saudi Arabia’s renewable energy capacity, as set out in Saudi Vision 2030,” says Yazeed Alhumied, Deputy Governor and Head of MENA Investments at PIF.

The first phase of the project is scheduled to start generating electricity in the second half of 2022, adds ACWA.

Saudi Arabia develops renewable energies

Masdar also recently announced the commissioning of the country’s first wind farm, with a capacity of 400 MW.

The Dumat al-Jandal project by Masdar and EDF Renewables is also the largest in the Middle East.

It will eventually supply electricity to 70,000 Saudi households.

In April 2021, Saudi Energy Minister Prince Abdulaziz bin Salman inaugurated the Sakaka IPP PV project.

This was the kingdom’s first renewable energy project, with a generating capacity of 300 MW.

At the time, the kingdom had already signed 25-year power purchase agreements for seven solar projects.

Saudi Power Procurement Co will be the supplier for these projects.

With a total capacity of 3.67 GW, they will power 600,000 homes, reducing GHG emissions by 7 million tonnes.