Amazon has become the world’s largest purchaser of renewable energy.

Its goal is to achieve carbon neutrality by 2040, ten years ahead of the target set out in the Paris Agreement signed in 2015.

Amazon deploys 232 renewable energy projects worldwide

After becoming the world’s leading purchaser of renewable energies (RE) in Europe, Amazon is now the world’s leading buyer.

The company has launched a total of 232 renewable energy projects across the globe.

Once they are all up and running, they should be able to supply nearly 2.5 million people in the United States alone.

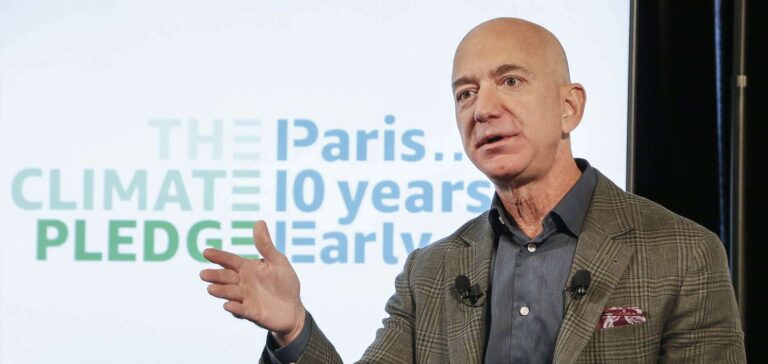

With this in mind, the company co-founded The Climate Pledge initiative with Global Optimism in 2019.

The objectives are multiple.

The first is to achieve a net zero carbon footprint by 2040.

The second is to power local activities with 100% renewable energy by 2025.

The latter measure is 5 years ahead of the original 2030 target.

Investments worldwide

Amazon’s investments in solar and wind power are not limited to the United States.

14 new projects are in the pipeline in various countries.

In Europe, a new wind farm is due to be built in Finland by 2022.

As for Spain, a fifth project financed by the company is due to see the light of day by 2023.

This will bring the country’s total capacity to 520 MW.

The largest project in the pipeline, however, remains on the American continent.

It aims to support parks in Vulcan County and Alberta, Canada, to power an additional 100,000 homes.

Leadership in the energy transition

The solar and wind energy projects have been designed to meet the company’s needs.

Ultimately, they should provide all the energy required for the company’s offices and Amazon Web Service (AWS) data center.

On the one hand, this initiative will create hundreds of jobs.

On the other hand, it will be a major investment in local businesses.

Decarbonizing all electrical systems

Amazon’s leadership in the sector encourages the decarbonization of the electricity system.

Their commitments are intended to be a civic gesture.

In other words, it’s about showing the right gestures to adopt to protect the planet while meeting energy and business needs.

In this sense, the group is strongly supported by the US Solar Energy Industries Association (SEIA).

Amazon’s strength lies in its ability to encourage.

Its efforts in the RE sector have made it the world’s leading purchaser.