Aker Horizons ASA announced on May 9 the merger of its subsidiary Aker Horizons Holding with Aker MergerCo, an entity of Aker ASA, as part of a major reorganisation of the group. The transaction, expected in August, provides that shareholders of Aker Horizons ASA (excluding Aker Capital) will receive for each share held $0.025 in cash and 0.001898 Aker ASA share. The holding thus transfers all its activities, including stakes in Aker Carbon Capture ASA (ACC), Mainstream Renewable Power and SuperNode, as well as the real estate assets in Narvik.

Merger and asset redistribution

The merger results from a strategic review aimed at refinancing the group’s structure and reducing its financial risks. On the same day, ACC announced the sale of its 20 % stake in SLB Capturi to a subsidiary of Aker ASA for an amount of $63mn. This transaction, finalised on May 14, is part of a strategy to divest non-strategic assets. According to the half-year report, the merger provides for the transfer of all assets and liabilities of the holding, while Aker Horizons ASA will retain around $2mn in cash and a convertible claim of $160mn.

The company indicates that, following the merger, it will remain listed on the Oslo Stock Exchange. The shareholders of Aker Horizons ASA will keep their shares. The Board of Directors will work to define the future strategy of Aker Horizons once the transaction is completed, with a commitment to communicate any developments.

Exceptional losses and portfolio restructuring

The half-year results published on July 15 show a consolidated net loss of $33mn on continuing activities, mainly due to debt costs and currency losses. The activities to be sold, presented as discontinued in the accounts, show a net loss of $186mn. This loss includes a write-down of $26mn on the sale of SLB Capturi and an impairment of $46mn on the offshore wind assets of Mainstream Renewable Power, following the decision to accelerate the exit from projects considered risky.

Moreover, the group repaid its green bond of $250mn at 100.37 % of the nominal in May and cancelled an unused credit facility of $550mn. Mainstream Renewable Power, now led by Morten Henriksen since April, has refocused its strategy on its key markets and sold to Celsia a Colombian portfolio of 675 MW consisting of wind and solar projects.

Post-merger outlook and risks

After the merger, Aker Horizons ASA’s financial risks will depend on Aker MergerCo’s ability to honour its commitments on the convertible debt. The company has limited means to finance its remaining operations and may have to seek new funding. The future strategy and the sustainability of Aker Horizons’ listing are still being defined.

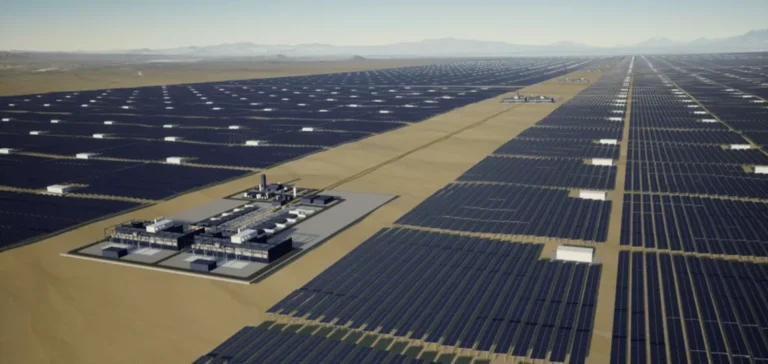

The outgoing portfolio also includes the subsidiary Aker Horizons Asset Development, which sold its Rjukan project to Norwegian Hydrogen and halted the development of the Narvik Green Ammonia project. The Narvik land will now be valued for data centre projects, in response to growing demand for digital infrastructure. SuperNode, another transferred asset, has completed its superconducting cable tests and has partnered with Taihan Cable & Solution to develop the next generation of power transmission technologies.