Afghanistan has a wealth of untapped minerals.

Estimated at $3 trillion by former minister Wahidullah Shahrani, the country’s natural resources represent a highly attractive energy asset.

But the country has been plagued by instability since the return of the Taliban to power.

Afghanistan can bank on energy

Afghanistan is a mine of untapped fossil resources, from metals such as copper and gold to oil and coal.

But above all, Afghanistan has the potential to become a major supplier of the rare metals needed to harness renewable energies.

These include lithium, uranium, lead, zinc and bauxite.

With energy prices soaring as a result of the health crisis, Afghanistan has an opportunity to make the most of its resources.

Resources that could boost the country’s economy.

But also to revive the Afghani, whose price could be affected by the political context.

Long-term investments in sight

Betting on Afghanistan’s resources represents a lucrative and beneficial long-term investment.

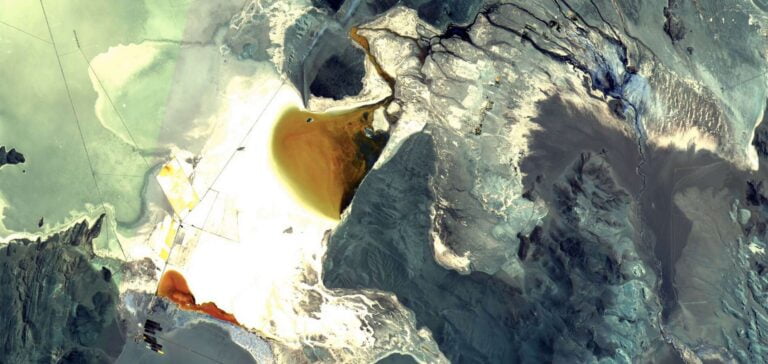

In the case of copper, the Metallurgical of China Consortium (MCC) has already invested in a 30-year project since 2008.

This makes the Aynak project the largest copper project in the country.

Representing 11 million tonnes of copper, it is worth around $100 billion.

Large reserves of rare metals

A 2019 report by the Ministry of Mines and Petroleum estimated copper resources at almost 30 million tonnes.

An estimate supported by the Ministry’s roadmap estimating that there are still 28.5 million tonnes in porphyry deposits.

Combined, these figures represent 60 million tonnes of copper, worth hundreds of billions of dollars.

Saudi Arabia of lithium

In 2010, a memo from the US Department of Defense described Afghanistan as a “Saudi Arabia of lithium”.

In choice words, the U.S. presented the country as a major global supplier of battery metal.

This parallel was drawn at a time when lithium was not yet being used for electric vehicles and the energy transition.

Also, a 2017/2018 US geological survey found deposits of spodumene.

However, this lithium-bearing mineral could not be estimated in quantitative terms, and was not mentioned on the Afghan side.

However, Afghanistan has announced that it holds 1.4 million tons of rare earths, with nearly 17 elements used in electronics and military equipment.

A brake on the military?

Nevertheless, the exploitation of these resources could be limited to electronics.

If Wahidullah Shahrani’s 2010 interview is anything to go by.

The BBC asked about the potential exploitation of these resources in the context of the confrontation between UN forces and the Taliban.

The former minister dismissed this possibility, locating the deposits in “the most secure areas of the country”.

Today, however, the Taliban rule the country.

Gold

At the same time, a 2019 report by the Afghan Ministry mentions nearly 2,700 kg of gold, worth $170 million to the country.

A tiny resource, compared with iron ore, estimated at 2.2 billion tonnes, or $350 billion on today’s market.

To this must be added the many sources of metals such as aluminium and zinc, which are located in many areas of the country.

High oil and gas potential

The country is home to 16 trillion cubic feet of natural gas and 500 million barrels of liquid natural gas.

There are also 1.5 billion barrels of oil, valued at $107 billion.

According to these reports, the majority of these oil deposits are in the Tajik Afghan Basin, whose exploitation would benefit the local community.

Lithium, oil, gas and precious stones

Finally, Afghanistan is a historic mine of lapis lazuli, rubies and emeralds.

These are precious stones priced at $150 per carat.

At present, however, their exploitation is not fully organized by the authorities.

In other words, most mines are illegal.

In short, Afghanistan is a country rich in fossil resources.

Some are even essential to the country’s energy transition.

More often criticized for its political situation than for its business potential, the country represents an almost virgin mine.

With few mining projects on the ground, Afghanistan could make the most of its opportunities.

And become one of tomorrow’s leading energy suppliers.