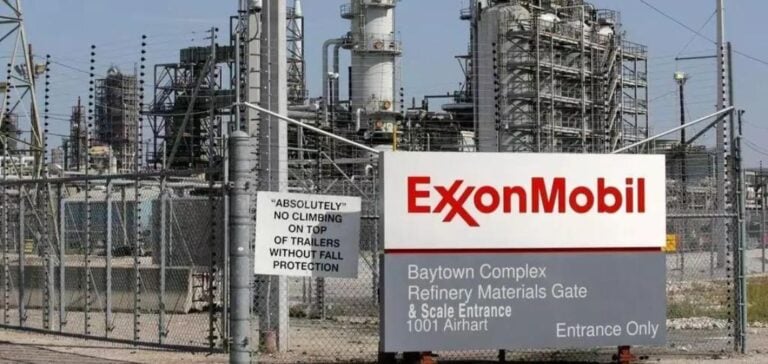

Abu Dhabi National Oil Company (ADNOC) announces the acquisition of a 35% stake in a future hydrogen plant in Texas, developed by Exxon Mobil Corporation.

This project represents a strategic step forward for the two energy giants in their shared goal of promoting hydrogen as a vehicle for energy transition and the reduction of greenhouse gas emissions.

The plant aims to produce up to 1 billion cubic feet of hydrogen per day, capturing 98% of carbon dioxide (CO₂) emissions, making it one of the most ambitious facilities of its kind in the United States.

A strategic project for blue hydrogen

The hydrogen production plant in Texas is part of Exxon Mobil’s strategy to develop low-carbon technologies and capture opportunities in the blue hydrogen sector.

ADNOC, for its part, sees this collaboration as a means of diversifying its energy assets and meeting the growing expectations of global markets for low-carbon solutions.

Michele Fiorentino, ADNOC’s Executive Vice President for Low-Carbon Solutions and Business Development, says the hydrogen produced could be destined for Exxon Mobil’s refining system or sold to third-party buyers connected to the Gulf Coast pipeline network.

In addition, the project could also include the production of blue ammonia, used as a means of transporting hydrogen and mainly exported to Northeast Asia and Europe, regions with high energy demand.

These markets are seeking to diversify their energy sources and meet their climate objectives by investing in blue hydrogen and other forms of renewable energy.

Development prospects and competitiveness

The final investment decision for this project is expected by mid-2025, with production start-up scheduled for 2029.

Scaling up to full capacity is expected to take 12 months, depending on demand.

Fiorentino points out that the size and scale of this project will enable hydrogen to be produced at one of the most competitive costs on the market, strengthening ADNOC and Exxon Mobil’s position in the low-carbon energy sector.

Although the exact cost of the investment remains confidential, Fiorentino suggests that it could amount to several billion dollars.

He also mentions the possibility of adding a second production line if demand warrants.

This extension could increase blue hydrogen production capacity, responding to the evolving energy needs of European and Asian industries.

Implications for the global energy transition

This project highlights the growing role of hydrogen in the global energy transition.

Major energy companies such as ADNOC and Exxon Mobil recognize the importance of hydrogen as a lever for reducing the carbon footprint of heavy industry and transportation.

The development of infrastructures such as this hydrogen plant in Texas could transform the energy landscape, offering viable alternatives to traditional carbon-intensive energy sources.

Initiatives of this kind demonstrate the commitment of major players in the oil and gas sector to meeting the expectations of markets and regulators while supporting their growth strategies.

Alignment with global climate objectives and the development of innovative energy solutions are becoming essential criteria for the future success of energy companies.

ADNOC’s investment in this blue hydrogen plant thus represents a strategic step not only towards diversifying its energy assets, but also towards building a more sustainable energy portfolio.

This move is essential for oil and gas players seeking to adapt to the changing dynamics of the global energy market.