ADIPEC, Abu Dhabi International Petroleum Exhibition, will be sponsored by the Japanese Ministry of Economy, Trade and Industry (METI).

Japan will be the official partner country for the 2021 edition of the event.

ADIPEC 2021: UAE Japan’s main trading partner

METI and ADIPEC highlight their role in unifying the global oil, gas and energy ecosystem.

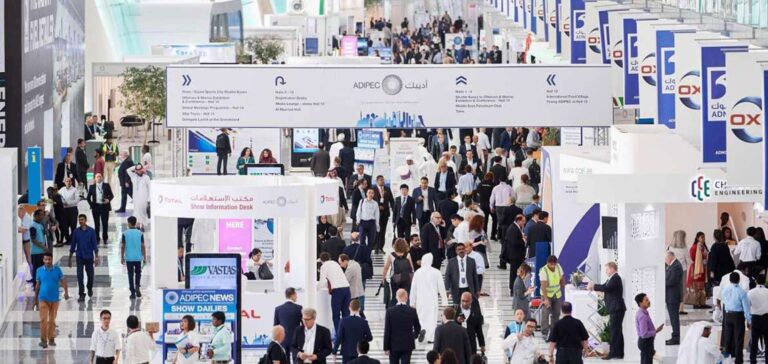

ADIPEC is one of the world’s leading energy events.

It enables industry experts to exchange ideas and information that shape the future of the energy sector.

Japan is the UAE’s largest trading partner worldwide.

Japanese investments and cutting-edge technologies therefore play a key role in supporting the UAE’s development.

This is particularly true in the fields of technology, energy transition, aviation and healthcare.

Reducing CO2 emissions: the major theme of the event

One of the objectives is to develop technologies that reduce carbon emissions.

Indeed, this will be the major theme of ADIPEC 2021, to be held in Abu Dhabi from November 15 to 18.

The event is hosted by the National Oil Company (ADNOC), a key player in the UAE’s growth and diversification.

Closer bilateral cooperation on energy issues

This partnership follows a virtual meeting between the UAE Minister of Industry and Technology and his Japanese counterpart.

During this meeting, they agreed to cooperate in the field of ammonia fuel and carbon recycling technologies.

Ammonia will play an important role in the development of the hydrogen economy in the future.

It can be used as a hydrogen carrier and as a zero-emission fuel.

Japan, the world’s largest oil importer

Japan also reaffirms its status as ADNOC’s largest international importer of oil and gas products.

It imports around 25% of its crude oil from the UAE.

Non-oil trade between the UAE and Japan has reached $130.8 billion in recent years.

This event will therefore be an opportunity to reaffirm the commercial ties between these two countries.

Reducing CO2 emissions will also be at the heart of conversations.