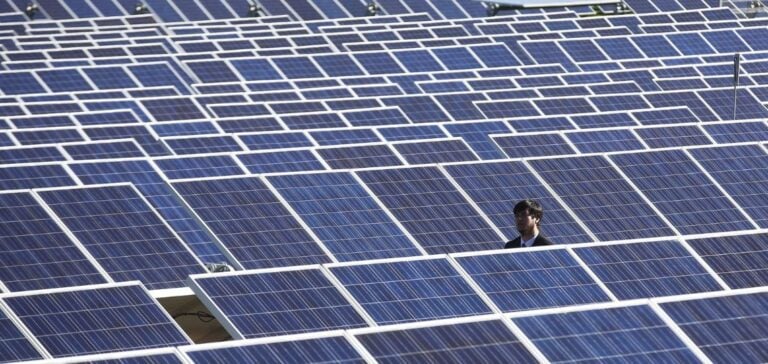

Shikun & Binui Energy, a subsidiary of the Israeli Shikun & Binui group, has announced a €49 million financing package from Raiffeisen Bank International (RBI). The loan is for the construction of a 101 MW photovoltaic (PV) park at Simleu Silvaniei, in Salaj county, north-west Romania. This project represents a major step forward in the company’s portfolio of renewable projects in Romania.

Opportunities in the Romanian energy market

The financial arrangement enables Shikun & Binui Energy to sell the electricity generated on the Romanian wholesale market or via power purchase agreements (PPAs) with trading companies and suppliers. This flexibility enables the company to maximize revenues by targeting end-customers directly. The Simleu Silvaniei project is Shikun & Binui Energy’s second solar project to receive financing in Romania. Last year, the company secured a €40.5 million credit facility from RBI and Raiffeisen Bank Romania to develop a 71 MW PV farm in Satu Mare county, also in the north-west of the country. The Satu Mare project is now in the final stages of construction. The country’s energy market is growing thanks to the many projects underway in the area.

Partners and development prospects

For the construction of the Simleu Silvaniei project, Shikun & Binui Energy chose CJR Renewables as main contractor. The company was also selected for the Satu Mare project, confirming its ongoing collaboration with Shikun & Binui Energy on large-scale energy projects in Romania. Shikun & Binui Energy is currently working on a portfolio of renewable energy projects in Romania totaling 841 MW of solar capacity and 554 MW of wind capacity. These projects are at various stages of development and demonstrate the company’s commitment to strengthening its presence in the Romanian renewable energies market. Shikun & Binui Energy CEO Didi Paz said, “We see significant opportunities in Romania’s renewable energy sector and are strengthening our presence in this market with a substantial project pipeline exceeding 1.5 gigawatts.”

Implications and growth strategy

Shikun & Binui Energy’s strategy is aligned with the objectives of growth and asset diversification. Romania, with its natural resources and regulatory framework, represents a key market for investment in renewable energies. By diversifying its assets with solar and wind power projects, the company is positioning itself as a major player in the region’s energy sector. The total capacity of over 1.5 GW under development by Shikun & Binui Energy in Romania demonstrates not only the company’s confidence in the potential of the Romanian market, but also its commitment to maximizing financial returns and solidifying its position in the renewable energy sector.