EDF has arranged loans with maturities of three to five years with renowned international banks such as BNP Paribas and Bank of America to support its Grand Carénage program. Launched in 2011, this ambitious program calls for substantial upgrades to French nuclear power plants to extend their operation beyond 40 years, with a budget adjusted to 49.4 billion euros by 2020.

Post-Fukushima Upgrades and Safety

The Grand Carénage includes safety improvements in response to the Fukushima Daiichi nuclear accident. These upgrades enable us to meet the stringent requirements set by the French Nuclear Safety Authority (ASN). ASN has established the conditions for the continued operation of 900 MWe reactors beyond their fourth decade.

Alignment with the European Taxonomy

In 2022, the European Union recognized certain nuclear activities as official green investments. A decision that brings EDF’s investments into line with European taxonomy. This marks an important step, reinforcing the role of nuclear power in Europe’s energy transition.

Economic and environmental impact

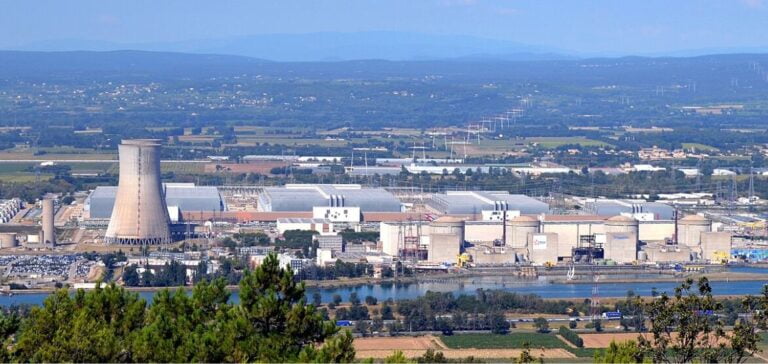

Financing these projects not only boosts French energy security, but also stimulates the local economy by creating jobs and supporting the supply chain. The first reactor to benefit from these measures is unit 1 at the Tricastin power plant. It was the first in France to be granted a license to operate beyond 40 years, in August 2023.

The financing and upgrades planned by EDF under the Grand Carénage project demonstrate a strategic fusion of managing the age of nuclear infrastructures and adapting to modern safety and energy efficiency standards. These efforts position France as a leader in nuclear safety and sustainable energy production.