German industry’s interest in green power purchase agreements (PPAs) is currently outstripping what suppliers can offer. Vattenfall plans to market 2 TWh/year from 28 major German solar projects by 2026. This increased demand reflects a growing awareness of the need for an energy transition, despite the challenges posed by fluctuating energy prices and regulatory complexities.

Impact of Regulatory Reforms

EU electricity market reforms, notably the simplification of state guarantees for PPAs, are expected to provide fresh impetus to the PPA market in Germany. These regulatory developments, combined with robust industrial demand for renewable energies, create an environment conducive to rapid growth in the solar sector, despite the uncertainties associated with wholesale energy prices.

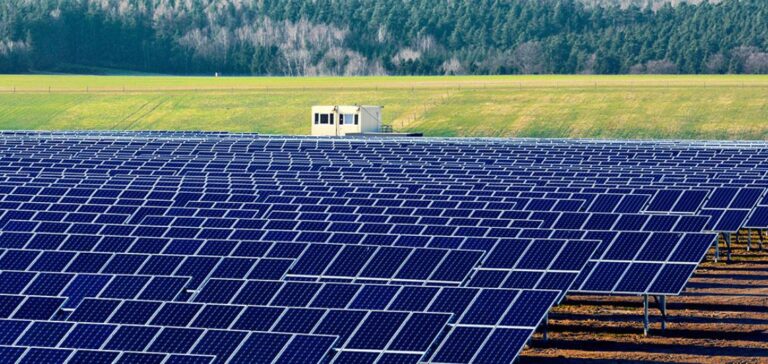

The rise of large-scale solar power

Germany has added a record 14 GW of solar capacity by 2023, affirming its position as European market leader in renewable energies. Vattenfall’s large-scale solar projects, which are free from state support and operate on a merchant basis, illustrate the sector’s adaptability and responsiveness to market demands and consumer preferences for local, sustainable energy sources.

Wind and Solar Market Differentiation

The market for onshore wind power in Germany has evolved differently from that for solar power, with the emphasis on long-term support via calls for tender. However, the persistent demand for solar APPs, particularly from large industries, underlines a fundamental trend towards diversifying and securing renewable energy sources, despite the distinct regulatory and development paths of wind and solar.

The potential of PPAs in Germany is estimated at 192 TWh/year by 2030, representing a quarter of national electricity demand. This outlook, supported by strong industrial demand and favorable regulatory reforms, positions PPAs as a key pillar of Germany’s energy transition, offering a pathway to decarbonization for companies of all sizes.