Scatec subsidiary Release has announced a major financial transaction with Climate Fund Managers (CFM), securing a $102 million investment. The funds raised through this transaction, totalling NOK 1.1 billion, will play a crucial role in propelling Release’s growth as an independent platform.

Working with Climate Fund Managers

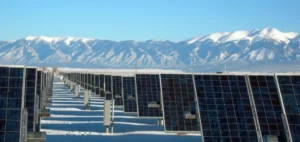

Release, established by Scatec ASA in 2019, specializes in providing flexible, mobile rental solutions for pre-assembled, modular solar and energy storage equipment. These solutions are aimed primarily at the mining and utilities sectors. Climate Fund Managers, a climate-focused blended finance fund manager backed by FMO and Sanlam Infraworks, has invested in Release via its Climate Investor One (CIO) fund. This fund focuses on renewable energy infrastructure in emerging markets.

CFM’s investment in Release includes $55 million in shares, giving them a 32% stake in the company. Scatec will continue to hold the majority of shares, retaining 68% ownership. In addition, CFM will provide shareholder loans totaling $47 million, some of which will be on concessional terms.

Release’s Innovative Approach to Renewable Energies

Release’s innovative approach to distributed generation photovoltaics and energy storage systems (BESS) focuses on projects starting from blocks of 5 MWp. The company’s modular solution consists of pre-assembled mobile tracking devices and storage containers. These assets are pre-financed and deployed through a simple, adaptable leasing agreement, with a term of at least 5 years and up to 15 years, similar to leasing a car. This mobility allows Release to assess the useful life of the equipment, enabling profitable short-term contracts, even for 5-year leases. This flexibility guarantees competitive pricing while maintaining high quality service and technology.

Release Traction on the Market and Future Projects

Release has achieved significant market traction, particularly with African utilities. It currently has projects in operation and under construction in Cameroon, South Africa, Mexico and South Sudan, with a total capacity of 47 MW in photovoltaics and 20 MWh in energy storage. The company also signed additional contracts for 35 MW of photovoltaic power and 20 MWh of storage in Chad, in addition to developing its advanced pipeline. Release intends to replicate its rapid deployment model to address energy supply gaps in the region’s local grids.

“Our blended finance model has facilitated the integration of impact finance into the deal structure, which Release will be able to leverage to improve its cost structure for its energy storage and grid connection solutions,” said Darron Johnson, Head of Africa Investments at Climate Fund Managers. “We are delighted to support the Release team as they deploy their essential climate technology in Africa, making a significant contribution to reducing emissions from the mining and utilities sectors.”

Scatec subsidiary Release has secured a substantial investment from Climate Fund Managers, positioning itself for further growth and innovation in the renewable energy sector. This partnership reflects the growing importance of renewable energy solutions in emerging markets, and underlines both companies’ commitment to sustainable, impactful projects.