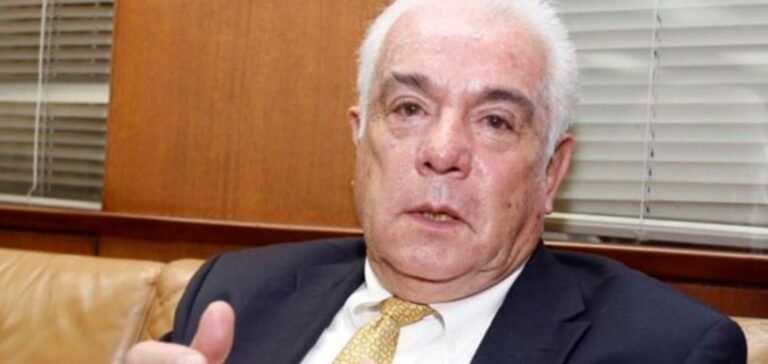

On Wednesday, Fernando Santos, Ecuador’s Minister of Energy, said that dismantling the oil field in the Amazonian reserve of Yasuni within a year would be complicated. A few days after the vote to stop production, he made this statement. Ecuador’s Minister of Energy is Fernando Santos.

Yasuni referendum results in closure of Block 43 despite technical challenges

Requested by an environmental group for ten years, the referendum, held on August 20, stipulated that in the event of a “yes” vote, the decision would be enforceable within a year. According to the provisional results of the National Electoral Council (CNE), 59% of voters gave their approval to the cessation of production of “Block 43”. This block is responsible for extracting 12% of the 466,000 barrels/day produced in Ecuador.

“This is a very complex (dismantling) process, never in the history of oil (…) has such a large deposit, producing 60,000 barrels a day, been closed so suddenly,” Mr. Santos told reporters.

He pointed out that this dismantling involved dismantling the installations. These installations consist of thousands of tons of steel, cables and various fittings.

Ecuador’s economy shaken by decision to close Yasuni Park deposit

Located in Yasuni National Park, the deposit covers 80 hectares of an area of almost one million hectares. In operation since 2016, its current output is the fourth highest in the country. Block 43″ contributes “around $1.2 billion to the general state budget”, according to Petroecuador.

“The one-year deadline is physically impossible to meet, unless we use bulldozers,” said Mr. Santos.

He indicated that the government of conservative President Guillermo Lasso would leave the technical studies ready for the closure of the Block 43 wells. Amazon defenders and indigenous peoples see this victory as a symbol of climate democracy. For its part, the government sees this situation as a “blow to the economy” of Ecuador. The country is heavily dependent on oil, its main export.

“This sets a terrible precedent, there are signed contracts, long-term commitments, the country’s legal security is in question,” the minister asserted.

The government estimates the losses due to the end of operations on Block 43 at $16.47 billion over 20 years.