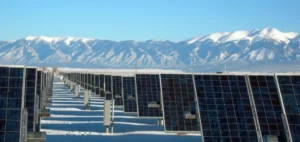

By 2022, China’s exports were primarily dominated by solar modules – with Europe remaining the country’s top solar module export market with a 56% share, according to Wood Mackenzie’s findings. But solar cells grew by more than 100% as the global photovoltaic market expanded, with Southeast Asia accounting for 31% of China’s solar cell exports.

U.S. tariffs on Chinese modules have pushed module production to Southeast Asia, where many manufacturing facilities import cells from China. Chinese modules maintained their cost competitiveness with other markets in 2022 and were up to 57% cheaper than modules made in the US and EU. This price differential was primarily due to material costs, where China holds the advantage due to its low energy costs, scale advantages, and government support, while solar module manufacturing in the U.S. and EU is not competitive without subsidies.

Conquering global markets

China’s photovoltaic production is expanding to conquer global markets. In addition to domestic supply needs, China’s export capacity for wafers and upstream cells is expected to reach more than 230 gigawatts (GW) by 2026, more than enough to meet the global demand outside of China of 170 GW by that year.

China’s PV industry is highly profitable and reinvests its profits to expand its domestic capacity, while attracting new investors. Available module capacity for export is also expected to increase gradually to 149 GW by 2026, leaving some room for growth in other markets for module production. More and more manufacturers are investing in upstream areas, which are more profitable than modules. The U.S. government’s goal of producing 100% U.S. modules by 2026 will be difficult to achieve due to a significant lack of wafer and cell production in the region, and incentives cannot fully close the manufacturing cost gap between U.S.-made modules and those from China.

With a mature supply chain and large production capacity for export, Southeast Asia has benefited from Chinese trade policies targeting PV in the United States as more module production has moved to the region. However, Chinese manufacturers hold 55% of Southeast Asia’s PV manufacturing capacity, which relies on components produced in China. Companies outside of China also have opportunities, but it will be difficult for them to escape China’s low-cost supply chain and its pool of expertise that has taken over a decade to develop.