Mytilineos reaches financial close with lenders ANZ and Westpac for the financing of three solar power plants in Australia.

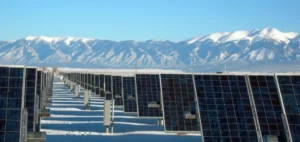

A project composed of three solar parks

Mytilineos specifies that the financing concerns the solar parks of Moura, Wyalong and Kingaroy in Australia. The 237MWp portfolio was subject to a phased acquisition between 2019 and 2020. The transactions were part of the company’s strategic investment in the Australian market.

Mytilineos’ portfolio includes the 110MWp Moura solar farm at Banana Shire in Queensland. In addition, it integrates the 75MWp Wyalong solar field in Bland Shire, New South Wales. Finally, the portfolio also includes the 53MWp Kingaroy solar park.

Once built, these solar farms will produce about 500GWh of renewable energy per year. This power will reduce carbon dioxide emissions by approximately 400,000 tons per year. Nikos Papapetrou, executive director of Mytilineos Renewables says:

“Australia is a key market for Mytilineos’ global renewable energy development strategy, which extends across the Asia Pacific, Europe and Latin America regions. We are pleased with the confidence in the Company and our vision in the region and look forward to many more successful financings for our future projects.”

Expansion in Australia

The majority of the electricity generated by the three projects will be sold under power purchase agreements (PPAs). In addition, the duration of APPs ranges from 7 to 10 years. For example, Moura has a PPA with CS Energy, Wyalong with NBN Co and Kingaroy with Smartest Energy.

The financing is structured as a combination of term, construction and ancillary facilities. In addition, the package totals A$234 million. ANZ’s Executive Director, Corporate Finance, Mark Clover, states:

“We are delighted to support Mytilineos’ second portfolio of investments in Australia, aimed at providing valuable renewable energy generation in New South Wales and Queensland as the states go net zero. As a global renewable energy company, Mytilineos’ expansion in Australia is encouraging and aligns with ANZ’s goal of financing and facilitating A$100 billion of sustainable solutions by 2030.”

Indeed, this is the second project financing of Mytilineos in Australia. In addition, this is the company’s second international solar investment plan. In addition, the company says it wants to continue its development in Australia by building additional projects in 2023.

Linklaters Allens acted as borrower’s counsel and White & Case as advisor. Vector Renewables acted as technical advisor and Baringa as market advisor. Finally, Willis Towers Watson acted as insurance advisor and Ernst & Young acted as tax advisor.