Departing from Algeria, the vessel approaches the French coast, accompanied by two tugs. The Lalla Fatma N’Soumer will unload 130,000 m3 of LNG at the Fos Cavaou terminal.

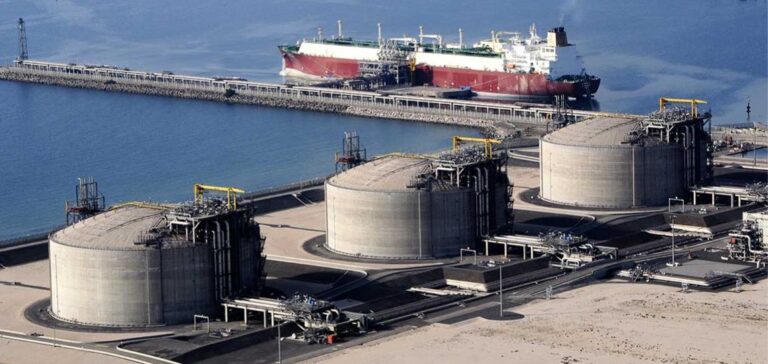

The Fos Cavaou terminal: a key point for LNG supply and offloading.

After an unprecedented year in 2022, the site remains in high demand for winter gas storage:

In the tanker, 250 m long and visible from afar with its four spherical tanks, there is enough gas to cover “the annual consumption of a city like Montpellier”, explains terminal manager Arnaud Catoire.

Behind him, a labyrinth of pipes runs through the industrial site the size of five French stadiums, located next to ArcelorMittal’s blast furnaces, 50 km from Marseille.

Unloading the LNG terminal in summer 2023: computerized management and operational efficiency

As the tanker is unloaded in the early summer of 2023, the site is almost deserted. Largely computerized, the LNG terminal, operated by Elengy (400 employees), a subsidiary of Engie, needs five people for this operation. Together with Cavaou, France’s four terminals, commissioned between 1972 and 2017, saw extraordinary activity in 2022, when the whole of Europe rushed to liquefy gas to compensate for the drying up of Russian pipelines linked to the Kremlin.

The growth of LNG imports into France and their crucial role in energy supply.

By 2022, LNG imports into France have more than doubled, making the country a major gateway to Europe. This makes France the leading exporter of LNG to Europe.

Imports “represented the equivalent of 70% of French gas consumption in 2022”, points out Nelly Nicoli, Managing Director of Elengy, which operates the Fos Cavaou, Fos Tonkin and Montoir-de-Bretagne terminals.

The fourth, at Dunkirk, is operated by the Belgian group Fluxys. In 2022, the utilization rate of Elengy’s terminals peaked at 95%, compared with around 60% before the energy crisis, which is unprecedented.

Maintaining winter LNG supplies despite the challenges of the energy crisis.

A year later, at Fos, activity has eased somewhat, but remained at high levels before the summer, with a utilization rate of 85%. We need to finish filling our winter stocks, while Europe will still have to do without Russian gas pipelines.

Without expressing concern about Europe’s ability to secure winter supplies, Elengy Strategy Director Christophe Thil nevertheless stresses that the use of import terminals should be “sustained” until the end of the year “in order to achieve this”.

Water for regasification

In 2022, France received a majority of 400 LNG cargoes from the United States, according to a report by the French Energy Regulatory Commission. Private Russian fields and Algeria are also sources of supply. Before reaching Fos, the fossil gas cools to -160°C, simplifying transport since it takes up 600 times less space in liquid form,” explains Thierry Labrousse, deputy terminal manager. After mooring, the LNG carrier connects to huge compass-shaped arms to recover the liquid gas, then stores it in huge tanks. It is then regasified by “trickling”. Under seawater showers at a temperature of 15°C, the temperature of the small pipes containing the liquid gas at -160°C heats up: it becomes gaseous again. Ready to be injected into the network after being odorized.

LNG regasification processes and environmental issues, with a view to sustainable alternatives.

For several years now, Fos-Cavaou has been offering to load LNG directly into tankers for service stations. Mr Nicoli also explains that LNG is decarbonizing land and sea mobility on ships. When burned, it emits fewer greenhouse gases than fuel oil and petroleum. However, environmental associations criticize its global footprint due to upstream methane leakage, which has a greater warming power than CO2.

“The idea is not to remain on a fossil-only supply,” insists Mr Nicoli, whose company is already working on its conversion, with the production of bio-GNL from waste by the end of 2025.

The site’s future could include capturing CO2 from industries in the Etang de Berre. It also plans to produce synthetic methane and liquid ammonia. These products are derived from hydrogen and are seen as the future of energy and the climate.