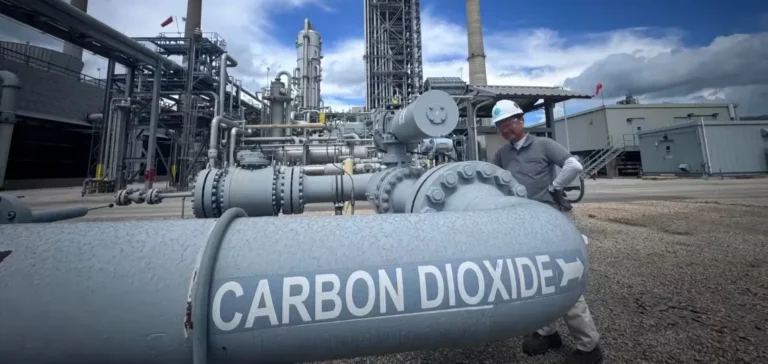

Carbon dioxide (CO₂) capture and removal solutions, long confined to laboratories or isolated pilot projects, are now central to the industrial and regulatory strategies of several major economies. The United States, European Union, United Kingdom, Denmark, Saudi Arabia, and Brazil are increasing investment and programmes to structure a value chain around these technologies, although current volumes remain far below required trajectories for meeting international climate agreements.

The United States and Europe accelerate pilot deployments

The United States is leading in bioenergy with carbon capture and storage (BECCS) applied to ethanol, with several projects targeting over 13 MtCO₂/year captured by 2028. Simultaneously, the federal government supports direct air capture (DACCS) through funding and tax incentives, though uncertainties remain regarding the long-term sustainability of federal subsidies. In Europe, the European Union and the United Kingdom are preparing methodologies to integrate biochar, DACCS, and BECCS into carbon quota systems (EU ETS, UK ETS), with implementation planned from 2026.

Legal structuring and storage hubs as strategic bottlenecks

CO₂ transport and storage hubs located in the North Sea, Gulf of Mexico, and Saudi Arabia are becoming geostrategic assets to attract projects and financing. However, the lack of a standardised legal framework hinders investment decisions. Issues related to rights over stored CO₂, long-term liability, and contractual validity of 10–20-year carbon removal credits are identified as major obstacles.

Biochar and incineration with capture lead bankable options

In the short term, only a few technologies offer cost profiles compatible with current carbon prices in compliance markets. Biochar, derived from agricultural or forestry residues, has a removal cost ranging from $100 to $250 per tonne of CO₂, while waste-to-energy with carbon capture (WECCS) projects could integrate into existing systems, notably in the UK and Scandinavia. Although politically supported, DACCS projects remain too costly to scale without significant subsidies.

Towards dual pricing and enhanced governance

Scenarios for the European Union by 2040 show that controlled integration of negative credits could significantly lower total compliance costs, with a potential saving of €37bn per year. However, stakeholders stress the need to separate credit types and create a secondary price signal for durable removals, which are rarer and more expensive.

Sectoral impacts and rise of new business models

Biochar and BECCS sectors are reshaping certain agricultural and industrial segments. Brazil, Indonesia, and West Africa are emerging as potential suppliers of high-quality carbon credits due to their abundant biomass. Meanwhile, utilities, energy majors, and developers are moving towards “infrastructure-as-a-service” models combining transport, storage, and credit verification.

An emerging energy sovereignty issue

In the medium term, the ability to maintain a domestic mix of removal solutions could become a metric of climate sovereignty, equivalent to energy supply security. Bilateral alliances are increasingly incorporating this dimension, with joint projects between the US and Canada, or Gulf countries and Asia, centred around co-development of DACCS/BECCS hubs and shared carbon governance systems.