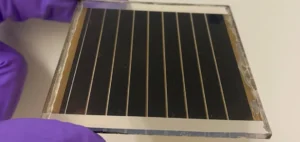

T1 Energy announced an intensification of its industrial operations in the United States with the completion of two capital raises totalling $100mn. These funds are allocated to support the initial phase of the G2_Austin solar cell project, a 2.1 GW facility planned in Rockdale, Texas. Meanwhile, the annualised output of the G1_Dallas site is expected to reach a run rate of 4.5 GW in the fourth quarter, doubling the average rate recorded earlier this year.

Industrial leverage to meet domestic demand

The raised funds include $50mn from a registered direct offering of convertible preferred shares and $50mn from a revised agreement with Encompass Capital Advisors. As part of this transaction, Encompass agreed to cancel its Series A preferred shares in exchange for newly issued common and Series B preferred shares, improving T1’s capital structure without additional debt. The company plans to complete G2_Austin financing with debt and anticipated customer prepayments to fund the first phase.

The G2_Austin development is structured in two phases and aligns with T1’s strategy to build a fully integrated US-based solar value chain. A 60% engineering completion milestone is expected before the end of November, enabling construction to begin in the fourth quarter. Production is still scheduled to begin by the end of 2026.

Financial results impacted by commercial dispute

In the third quarter of 2025, T1 reported revenue of $210.5mn but also a net loss of $140.8mn, significantly higher than the previous year. This deterioration was mainly due to a $53.2mn impairment of intangible assets linked to a contract dispute with a major customer. The company stated that the sales initially scheduled for the third quarter would be deferred to the fourth quarter.

In addition, T1 secured a strategic agreement with Nextpower to replace aluminium frames in its solar modules with locally produced steel frames. This move supports compliance with local content rules, a key requirement for qualifying for federal tax credits.

Towards scaled domestic solar manufacturing

T1 also acquired a minority stake in Talon PV LLC, a company developing a 4.8 GW solar cell manufacturing facility in Baytown, Texas. While distinct from G2_Austin, this investment highlights T1’s ambition to diversify its production capabilities and strengthen its US footprint.

The company anticipates annual EBITDA between $375mn and $450mn once G2_Austin Phase 1 is fully operational and G1_Dallas reaches 5 GW output. This outlook reflects efforts to prepare for regulatory changes and optimise access to Section 45X tax credits starting in 2026.