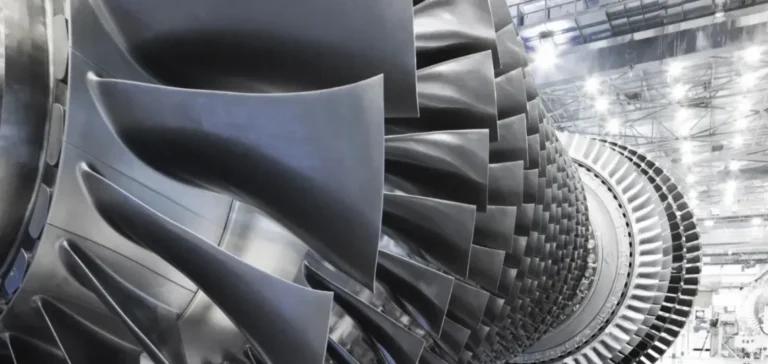

Maple Creek Energy LLC has reached a key milestone in developing its natural gas-fired power plant in Sullivan County, United States, by securing a GE Vernova 7HA.03 turbine and associated equipment. The project is led by Advanced Power in partnership with BDC Power Holdings LLC, a Bechtel affiliate, and financed by ArcLight Capital Partners, an investor specialised in infrastructure critical to electrification.

A critical asset to mitigate scheduling risks

The combined-cycle setup will integrate lower-carbon natural gas and recovered steam to produce up to 640 megawatts (MW) of electricity. This level of capacity could power approximately 630,000 households, according to company projections. The acquisition of this equipment comes as many power generation projects face supply chain constraints.

The Maple Creek project already holds required permits, land control, and a favourable position in the transmission interconnection queue. These elements enable the project to target commercial operations as early as 2029. The 7HA.03 turbine was selected for its established performance in efficiency, reliability, and fast ramp-up capability, according to specifications provided by GE Vernova.

Addressing rising electricity demand

The site is located in Zone 6 of the Midwest Independent System Operator (MISO), an area experiencing rapid increases in power demand. MISO forecasts a growth of up to 30 gigawatts (GW) by the end of the decade, driven by electrification, industrial onshoring, and the expansion of hyperscale data centres.

Bechtel Infrastructure & Power Corporation has been appointed as the engineering, procurement, and construction (EPC) contractor, reinforcing the project’s execution capacity. The stated objective is to deliver flexible, dispatchable electricity supply to meet the needs of fast-growing load centres.

Part of a broader Advanced Power portfolio

The Maple Creek project is part of Advanced Power’s broader development pipeline, which includes over 12 gigawatts (GW) of thermal and renewable generation projects and more than 9 gigawatt-hours (GWh) of energy storage. This portfolio aims to deliver scalable solutions aligned with the evolving power mix and market demand.