A Ukrainian citizen suspected of taking part in the 2022 explosions of the Nord Stream 1 and 2 gas pipelines in the Baltic Sea has been arrested in Poland at Germany’s request. Held in provisional detention for seven days, he may be extradited to Germany to stand trial. The German federal prosecutor’s office states that the individual, identified as Volodymyr Z., was involved in a sabotage operation near Denmark’s Bornholm island.

According to German authorities, the professionally trained diver was part of a group that deployed explosive charges against the two pipelines connecting Russia and Germany. These infrastructures carried most of Russia’s gas to Europe until operations ceased in 2022. The European arrest warrant issued by Berlin alleges that Volodymyr Z. was directly involved in the execution of the clandestine operation.

A judicial procedure awaiting German documentation

The suspect’s lawyer, Tymoteusz Paprocki, contested the detention decision before the Polish press, noting that his client had been legally residing in Poland for more than three years. He also stated that an appeal would be filed and highlighted that Polish authorities were still awaiting official documents from their German counterparts.

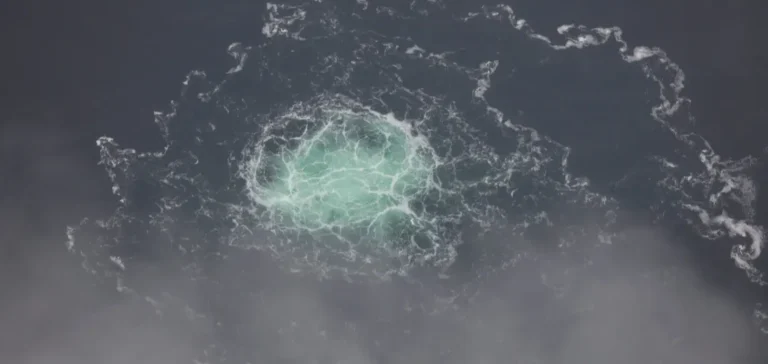

The underwater explosions that occurred in September 2022 caused four major gas leaks in the two pipelines. At the time, Nord Stream 1 had stopped deliveries amid geopolitical tensions between Russia and European allies of Ukraine. The second pipeline, Nord Stream 2, although completed, had never entered into service.

A Ukrainian cell at the centre of the German investigation

The ongoing German judicial investigation has identified a cell of six individuals — five men and one woman — all Ukrainian nationals, believed to be the main suspects in the destruction of the energy infrastructure in the Baltic Sea. Two of them have already been arrested in other European countries.

In August, another Ukrainian was arrested in Italy, and an Italian judge approved his extradition to Germany in mid-September. Judicial proceedings in Sweden and Denmark, initiated shortly after the explosions, were closed in 2024, leaving Germany as the sole country actively continuing the investigation.