Two major carbon capture and storage (CCS) projects in the United Kingdom have finalised contracts and are set to enter the construction phase. Located in Padeswood, Wales, and Ellesmere Port, North West England, these facilities will enable the combined annual capture of 1.2mn tonnes of carbon dioxide.

Consolidated industrial partnerships

The Padeswood site, operated by Heidelberg Materials UK, will become the first full-scale CCS-equipped cement plant in the country. It aims to capture around 800,000 tonnes of CO2 annually. The second project, led by Encyclis, involves a waste-to-energy facility at the Protos site and represents one of the world’s first full-scale carbon capture deployments in this sector. Both projects are now contractually tied to the Low Carbon Contracts Company, the public body overseeing financial commitments in the energy sector.

Shared infrastructure through the HyNet network

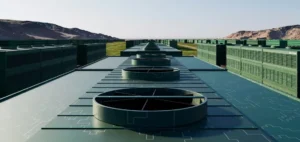

The two projects will connect to Eni’s carbon transport and storage network in Liverpool Bay, part of the HyNet industrial cluster. This network, made up of new and repurposed infrastructure, will transport captured CO2 to geological offshore storage sites. Backed by the UK government since April, HyNet aims to build a complete CCS value chain for heavy industries in the region.

Knock-on effects for local supply chains

The government initiative forecasts the creation of 500 direct skilled jobs across the two sites. According to data from the HyNet network, the wider cluster is expected to generate up to 2,800 jobs. Cement and waste treatment sectors, traditionally hard to decarbonise, will gain access to technological solutions allowing them to reduce emissions while maintaining operations.

Strategic positioning and knowledge transfer

By integrating these projects into its industrial strategy, the UK seeks to position itself on global carbon capture markets. The technologies deployed could be exported, generating economic benefits for the broader British industrial supply chain. The involvement of companies such as Heidelberg Materials and Encyclis suggests potential replication of this model across other carbon-intensive industrial sites.