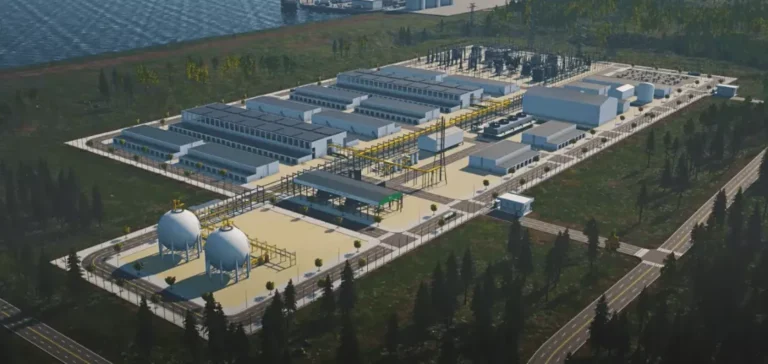

Monkey Island LNG has awarded McDermott a master services agreement to provide front-end engineering and planning services for its upcoming natural gas liquefaction terminal in Cameron Parish, Louisiana. The project’s first phase includes three liquefied natural gas (LNG) trains, each with a capacity of 5.2 million metric tons per annum (MTPA), totalling 15.6 MTPA.

Capacity to reach 26 MTPA with compact design

Total site capacity is expected to reach 26 MTPA through the planned addition of two extra liquefaction trains. McDermott’s proposed modular design would enable up to 60% more LNG per acre compared to similar projects. This higher production density on a smaller footprint aims to optimise the initial $25bn investment across two phases.

The facility will integrate the ConocoPhillips Optimized Cascade® Process, already selected by Monkey Island LNG. This technology choice is part of a strategy to reduce deployment risk by minimising land use and standardising modules.

Transition to EPC contract aligned with financing

Under the framework agreement, McDermott will deliver engineering, execution planning and cost evaluation services for the next phase of the project: the engineering, procurement and construction (EPC) phase. The current contract is expected to transition into a full EPC contract in line with Monkey Island LNG’s financing schedule.

Design and planning will be led by McDermott’s team in Houston, supported by its engineering centre in Gurugram, India. First LNG production is targeted for the early 2030s. The project relies on modular production infrastructure to be fabricated at McDermott-owned yards.

One of the largest private energy infrastructure projects

With a total announced investment of $25bn, the development is positioned as one of the largest private energy infrastructure projects in North America. The use of “mega-modules” is expected to reduce construction costs and commissioning timelines while improving industrial risk management.

The partnership between Monkey Island LNG and McDermott also highlights McDermott’s capacity to offer an integrated solution from engineering to fabrication, supported by its global infrastructure network.