The study, published in a leading journal, sets the global “prudent” capacity of geological carbon dioxide storage at 1,460 gigatonnes (GtCO2). This limit departs from higher “technical” potentials by embedding safety, governance and engineering constraints. The resource is mostly onshore with a smaller offshore share, which influences project feasibility, infrastructure capex and long-term liability management. Carbon capture and storage (CCS) and carbon dioxide removal (CDR) draw on the same subsurface reservoir and therefore compete directly for access to this scarce capacity.

What the 1,460 GtCO2 cap actually measures

The 1,460 GtCO2 limit is not a geophysical maximum but an estimate of mobilizable capacity under credible constraints. It stands against an unfiltered inventory of about 11,800 GtCO2, a figure of limited relevance for industrial planning. The authors note that dedicating the entire stock to net removals would still yield only limited cooling, which argues for a clear hierarchy of uses rather than assuming subsurface “abundance.” The larger the share assigned to at-source abatement, the smaller the remaining headroom for later removals, with direct implications for sectors labeled “hard to abate.”

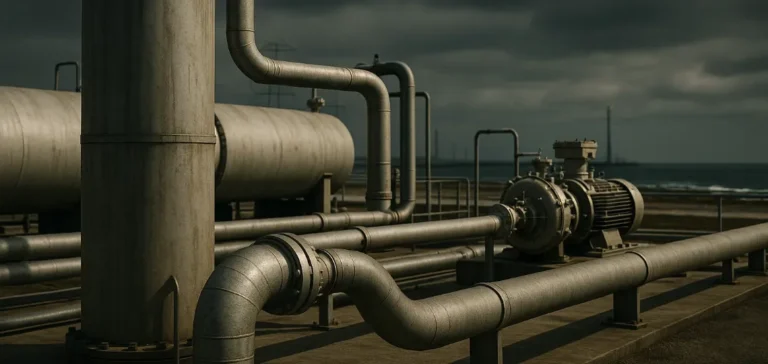

Net-zero trajectories cluster around a median need near 8.7 GtCO2 injected per year at the point of balance. This order of magnitude puts the CO2 system in the same industrial league as oil, in terms of scale. It implies a multiplication of injection wells, compressors, pipelines, port capacity and dedicated terminals, along with monitoring and site-closure systems. It also requires international standardization of performance through measurement, reporting and verification (MRV).

How the capacity was calculated

The methodology starts from a global map of sedimentary basins and then applies successive exclusion filters. These remove protected and polar areas, zones with seismic risk deemed incompatible with safe injection, and constrain injection depth to windows favorable to confinement and injectivity. The operational ranges are set to maintain CO2 in a supercritical phase while preserving seal integrity. Offshore, greater water depths raise installation, inspection and maintenance costs, narrowing the prudent perimeter to shallower shelves.

A buffer is also applied around existing and projected urban areas to limit hydrogeological and health risks. The Exclusive Economic Zone (EEZ) defines coastal-state rights and responsibilities for subsea injection, conditioning the bankability of offshore assets. The estimate is prudent by design: it privileges robust long-term usability over volumetric maximization. The limits therefore reflect how industry can operate under high-diligence requirements.

Geography: advantaged basins and constrained basins

The resulting map shows marked asymmetries. Countries with large, mature sedimentary basins retain substantial “prudent” capacity, notably the United States, Russia, China, Brazil and Australia. Others maintain robust potential given their geology, such as Saudi Arabia, the Democratic Republic of the Congo and Kazakhstan. By contrast, India, Norway, Canada and several European Union members see their prudent potential shrink noticeably once filters are applied.

This geography reshapes CO2 routes. Where domestic capacity is tight, the economic model favors cross-border corridors—by ship or pipeline—toward injection hubs. Pipelines lead on short-to-medium distances and for steady flows, while seaborne transport adds flexibility to adjust volumes and destinations. In both cases, logistics must integrate compression, possible reliquefaction, thermal losses and port safety, with strict traceability of volumes and effluent quality.

Legal framework: offshore and liability

Marine governance relies on EEZs to assign seabed use and associated responsibility. Cross-border CO2 transfers require specific agreements that govern proof, liability and access to remedy. The International Maritime Organization (IMO) sets safety standards for vessels and terminals, which sit alongside coastal-state environmental obligations. The International Tribunal for the Law of the Sea (ITLOS) influences how responsibility is shared when multiple states inject into the same basin.

Legal clarity is essential to attract long-term capital. Contracts must span the full chain—from characterization to post-closure monitoring—with guarantees for well and collector availability. Deferred liability is central, because injected CO2 becomes a long-dated obligation for operators and states. Well-defined transfers of liability from operator to state, tied to performance conditions, will be decisive for structuring tenders.

Sectoral trade-offs and order of merit

Scarcity forces a merit order across uses based on marginal effectiveness and controllability. Power generation and cement absorb large volumes because they combine concentrated streams, mature capture technologies and relatively standardizable monitoring. In steel, the choice pits hydrogen-based direct reduction against capture on blast furnaces, a decision that depends on the availability of electricity, hydrogen and mobilizable subsurface. In chemicals and refining, storage demand interlocks with electrification and feedstock substitution strategies.

Hydrogen from natural gas with capture (“blue hydrogen”) consumes subsurface capacity, whereas electrolysis-based hydrogen on carbon-free power (“green hydrogen”) does not. The relative shares of these pathways in national plans directly affect the speed at which the prudent cap is consumed. Scenarios that accept a temperature overshoot followed by large-scale removals draw heavily on the stock, with cumulative volumes ranging from several hundred to a few thousand gigatonnes depending on trajectories. This strengthens the case for an explicit, regularly updated merit order as costs and technologies evolve.

Risk, performance and surveillance

Seismicity is a key determinant. Areas where peak ground accelerations exceed prudent thresholds are excluded to limit fault reactivation and preserve seal integrity. The United States Geological Survey (USGS) and national peers provide reference maps used to rate seismic risk. Injectivity testing, pressure monitoring and pressure-management in semi-closed systems condition the durability of confinement. Very low residual leakage targets—on the order of hundredths of a percent per year—are needed to preserve the climatic value of stored tonnes.

MRV underpins project bankability. Time series of flow rates, pressure and integrity must be third-party-verifiable, harmonized and traceable. Metrology extends to transport: composition control, temperatures and pressures, and phase management (gas, supercritical liquid) to avoid cavitation and equipment erosion. Protocol standardization reduces uncertainty, lowers capital costs and accelerates asset replication. It also eases the placement of insurance policies tailored to long-term risks.

Mineralization and alternative pathways: a complementary role

Sedimentary basins concentrate most of the prudent potential, reflecting decades of geological characterization and operational feedback. In-situ mineralization in basalts is advancing and shows fast uptake kinetics under favorable conditions. Yet the near-term volumes remain modest relative to gigatonne-scale needs. Local variability in permeability, temperature and reaction kinetics complicates extrapolation and delays large-scale contribution.

Accordingly, “brownfield” strategies—depleted oil and gas reservoirs and deep saline aquifers already studied—offer faster execution paths. They leverage existing infrastructure, trimming time-to-service and geotechnical uncertainty. Ramp-up still depends on permitting, specialized labor availability and supply chains for steel, oil-well cement and compression equipment. Sector decision-makers are already tilting portfolios accordingly, assigning an option value to mobilizable subsurface.

Timing, local saturation and the overshoot horizon

Scenarios consistent with climate goals require injection beyond net zero, with annual rates reaching roughly ten to fifteen gigatonnes by century end. At basin scale, local saturation arrives before global exhaustion, pushing projects toward deeper, more distant or costlier provinces. Asian regions, including China and India, concentrate a large share of demand and risk early tension on prudent regional capacity. Planning must therefore anticipate successive investment waves and cross-border infrastructure pooling.

On multi-century horizons, most trajectories eventually breach the prudent cap if high injection rates persist to neutralize residual emissions and supply removals. A potentially asymmetric climate response to negative emissions increases pressure: each tonne removed may not mirror the effect of each tonne emitted. This asymmetry reinforces the economic value of upstream gross-emissions reduction, which preserves the subsurface option value for later, higher-utility uses. It justifies explicit intertemporal accounting of the resource by states and firms alike.

Political economy: pricing and capacity markets

Rivalry for subsurface space argues for capacity markets with multi-decade reservation contracts. Tariffs should internalize the full life cycle: characterization, drilling, compression, injection, MRV, closure and post-closure liability. Asset valuation hinges on durability metrics, often expressed as an annualized leakage rate. Below a very low threshold, the climatic value of stored tonnes is preserved; above it, value erodes quickly, compressing expected revenues. Investors will therefore demand targeted public guarantees and harmonized audit standards.

Debate on cost-benefit distribution crosses “capacity to store” with “historical responsibility for emissions.” Countries rich in prudent capacity but with low historical emissions could sell storage services to counterparts with constrained subsurface. Financial transfers, pooled insurance mechanisms and rules against double counting become essential to stabilize these trades. As contract tenors extend, institutional credibility—including work by the International Institute for Applied Systems Analysis (IIASA) and the Potsdam Institute for Climate Impact Research (PIK)—shapes market acceptance of underlying assumptions.

The study, by reducing a presumed “infinite” stock to a scarce resource, provides a steering instrument for investment decisions. Industrial players will need to state their share of usage between abatement and removals, detail their injection trajectories and secure logistics corridors. States will integrate subsurface scarcity into strategy, accelerate permits on safe sites and clarify liability regimes. The immediate question for every actor is straightforward: how much of this limited resource should be reserved now, for which use, and with what measurable performance guarantees over time?