Grenergy Renovables announced the signing of an agreement for the sale of the Gabriela phase of its Oasis de Atacama project to funds managed by CVC DIF, the infrastructure strategy of CVC Capital Partners. This phase represents 10% of the megaproject launched in northern Chile and could reach an enterprise value of $475mn, including financial adjustments and performance-based payments.

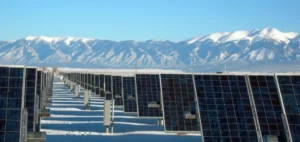

The Gabriela project includes 272 megawatts (MW) of installed solar capacity and 1,100 megawatt-hours (MWh) of battery storage. Currently under construction, the facility is backed by a signed hybrid power purchase agreement (PPA). The asset transfer will take place after the commercial operation date, expected in the first half of 2026.

Green syndicated financing for the Gabriela phase

Grenergy secured $324mn in green financing for Gabriela’s construction. The initial loan was structured with the participation of BNP Paribas, Natixis, Société Générale, Scotiabank and Sumitomo Mitsui Banking Corporation (SMBC). Later, several banks joined the financing syndicate, including Bank of America, BBVA, JP Morgan, KfW IPEX, Rabobank and Instituto de Crédito Oficial (ICO).

The agreement with CVC DIF also provides that Grenergy will deliver operation and maintenance services for the project for a period of five years. The company will rely on its technical partnerships to ensure the operational continuity of the facilities.

Asset rotation strategy and financial roadmap

With this sale, combined with the transaction concluded with ContourGlobal in December 2024, Grenergy has now monetised 33% of its Oasis de Atacama project. The company retains 1.2 gigawatts (GW) of installed capacity and 7.3 gigawatt-hours (GWh) of storage, corresponding to the remaining 67% of the programme.

This transaction forms part of the asset rotation strategy presented by Grenergy during its Capital Markets Day in London, which aims for total cash generation of €800mn by 2027. The proceeds will help finance the company’s €3.5bn investment plan through 2027.

Deployment of the hybrid model in other markets

Grenergy plans to replicate the solar-storage model developed at Atacama in other platforms such as Central Oasis, located in Chile’s central region, as well as in Europe, with the Escuderos project in Spain as a flagship. The company holds a global development pipeline exceeding 77.9 GWh of storage capacity and 12.5 GW of solar generation.

Chile remains a strategic market for Grenergy, where it has been active since 2013. The company intends to allocate nearly 70% of its investments there through 2027. It reports having connected the largest number of solar plants in the country and uses Chile as the base for developing its Oasis platforms.